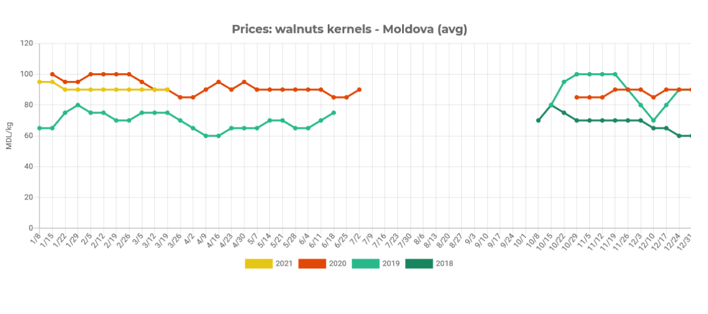

According to the monitoring of EastFruit, on the Moldovan market, the average wholesale prices for walnut kernels, having slightly decreased in mid-January 2021, have been stable for almost two months at the level of 90 MDL / kg ($ 5.1 / kg).

Operators of the Moldovan market considered it as “slightly higher than the average for this season of the last five years”. At the same time, in the first quarter of 2021, the difference between the wholesale prices for high (light halves) and low-quality kernels was small – about $ 0.5-1.0 / kg. Whereas, in the same period of the two previous years, the difference between the minimum and maximum prices (for the worst and the best quality grade) was more significant – $ 1.4-1.7 / kg. Also, in the beginning of 2019 and 2020, the volatility of all indicators of the Moldovan walnut market was much greater.

Walnut exporters believe that wholesale prices for walnut kernels in the spring 2021 in Moldova will no longer change significantly. Farmers have few walnuts left and the marketing season is almost over. The sale season for 2020 harvested walnuts will probably be the most stable in terms of price: the purchase domestic prices for kernels fluctuated in a relatively narrow range – 80-100 MDL / kg ($ 4.57-5.71 / kg), the average price for export deliveries was $ 6.16-6.20 / kg. The prices of the outgoing season are considered “not bad for a year of drought and pandemic” by the representatives of the Union of Associations of Producers of Nuciferous Cultures of Moldova, UAPCNM.

As EastFruit reported, in 2020, the harvest of walnuts (in shell) in Moldova amounted to about 14-16 thousand tons – this is only 50-60% of its production level a year earlier. Stocks of walnuts in agricultural enterprises and trading companies were almost completely depleted by mid-March. In the previous month, traders tried to purchase light halves of walnut kernels (Chandler, Fernor, and Peschansky varieties) for export to Germany. The proposed purchase prices were high – 120-125 MDL / kg ($ 6.85-7.14 / kg). However, even then, farmers had nothing to offer to exporters.

However, the UAPCNM industry union does not regard this as a big missed opportunity. With large amplitude of price fluctuations during the marketing season in 2018-2020, few walnut producers will continue to deliberately postpone their sales in spring in the hope of an increase in demand and prices for walnuts in theEuropean market (the main sales market).

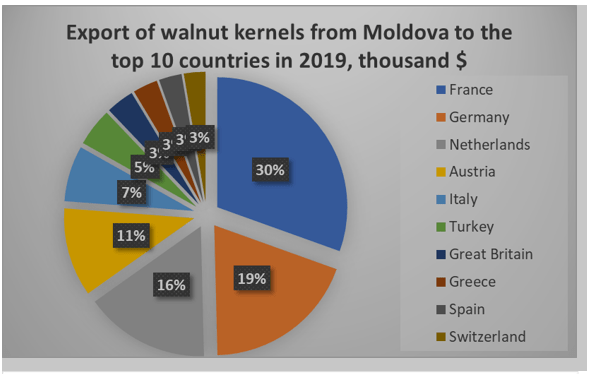

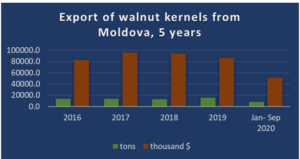

It is worth recalling in this regard that in the spring 2019 there was a surge in exports of walnut kernels from Moldova to the European Union (mainly Germany and France). However, then the walnut was purchased relatively cheaply (60-75 MDL / kg, $ 3.4-4.3 / kg) and was also exported at a low invoice price – on average $ 5.47-5.50 / kg. As a result, at the end of 2019, Moldova sold about 15.8 thousand tons of nut kernels to foreign markets (in 2018 – 13 thousand tons, in 2017 – 13.5 thousand tons, average invoice prices – $ 7.23 / kg and $ 7.07 / kg respectively).

It is worth recalling in this regard that in the spring 2019 there was a surge in exports of walnut kernels from Moldova to the European Union (mainly Germany and France). However, then the walnut was purchased relatively cheaply (60-75 MDL / kg, $ 3.4-4.3 / kg) and was also exported at a low invoice price – on average $ 5.47-5.50 / kg. As a result, at the end of 2019, Moldova sold about 15.8 thousand tons of nut kernels to foreign markets (in 2018 – 13 thousand tons, in 2017 – 13.5 thousand tons, average invoice prices – $ 7.23 / kg and $ 7.07 / kg respectively).

Another interesting observation is that the yield of walnuts in forest belts and alleys along the roads has sharply decreased due to the catastrophic drought last year in Moldova. Meanwhile, it is walnuts that still account for at least 50% of the export flow. It is often the object of competition between exporters and the cause of fluctuations in prices for walnut kernels in the domestic market. Probably, the lower amount of walnut from forest belts and alleys along the roads in the 2020-2021 season has also reduced the price volatility on the domestic market

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.