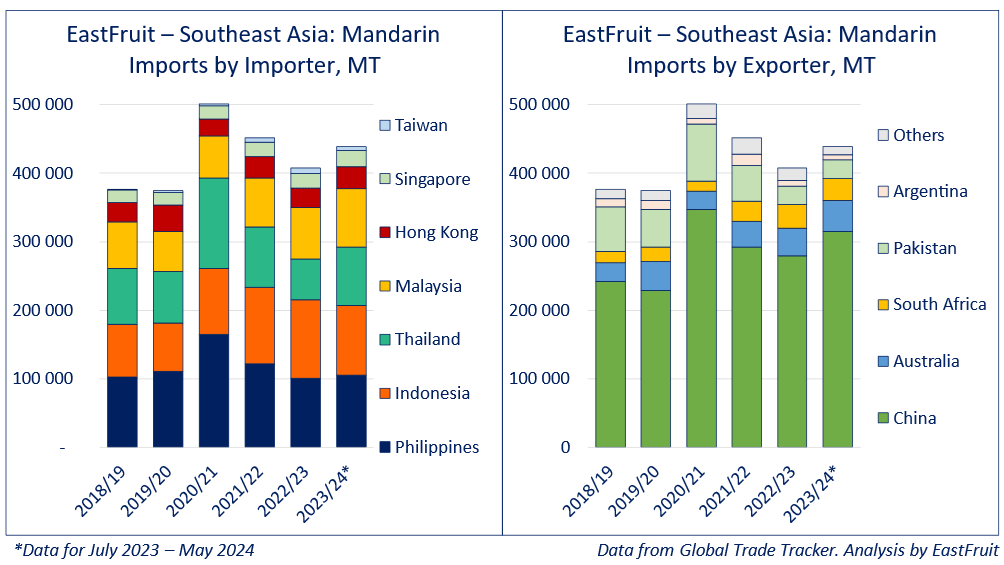

Mandarin imports in Southeast Asia have surged in the 2023/24 season after two years of decline, according to EastFruit. In the first 11 months of the current season (July 2023 – May 2024), key importers in the region (excluding Vietnam) brought in just under 440,000 tons of mandarins, an 8% increase over the entire previous season. If current trends continue, the final tally may only fall short of the record 2020/21 season, which saw just over 500,000 tons imported.

“Southeast Asia, excluding Vietnam, has the potential to import half a million tons of mandarins each season, with an additional 200,000-300,000 tons coming separately to the Vietnamese market per annum. This means the region could import up to 800,000 tons of mandarins per season. This volume is comparable to Russia’s annual imports (820,000-960,000 tons) and exceeds the combined imports of the EU and the UK (720,000-770,000 tons) or the US and Canada (540,000-650,000 tons). Unlike the markets in Europe or North America, most Southeast Asian countries are expected to see rapid consumer market growth in the coming years, opening up significant opportunities for new suppliers,” says Yevhen Kuzin, Fruit & Vegetable Market Analyst at EastFruit and International Consultant at FAO.

In addition to Vietnam, key mandarin-importing countries in the region include the Philippines, Indonesia, Thailand, Malaysia, Hong Kong, and Singapore. Since the 2018/19 season, each of these countries has increased their citrus import volumes. In the Philippines and Thailand, import growth averaged just 3%, while in other countries, it varied between 18-34%. Taiwan is the only country in the region that can sometimes become a net exporter of mandarins, although with relatively small export volumes.

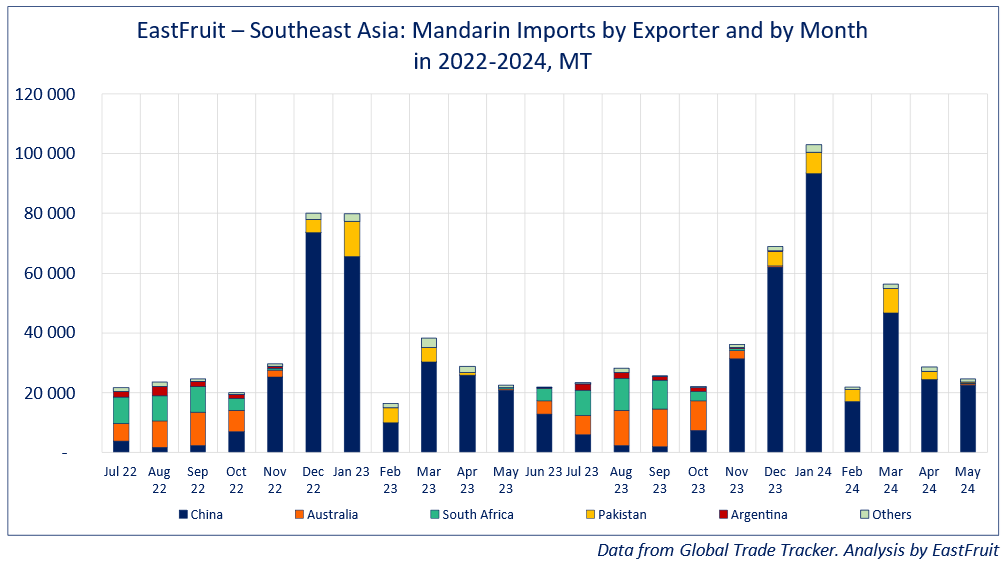

“The main supplier of mandarins to the region is China, accounting for 61-68% of total imports in Southeast Asia (excluding Vietnam). Chinese easy-peelers are available almost year-round, with peak supply in December-January. Southern Hemisphere countries are mainly present from July to October, making Pakistan the only relatively large competitor to China in the region. Due to these seasonal patterns, China and Pakistan are seen as the main opponents for Egypt and Morocco in Southeast Asia,” explains Hajer Magdy, International Fresh Produce Trade Consultant at FAO.

Currently, the presence of Egyptian and Moroccan products in the region is minimal. Last season, Morocco supplied 850 tons of mandarins, while Egypt exported just over 4,000 tons, making it the sixth-largest supplier. Both countries primarily target Hong Kong, Malaysia, and Singapore, with Egypt also present in Indonesia and Vietnam. However, in the 2023/24 season, both countries reduced exports to Southeast Asia to 630 tons (Morocco) and 1,600 tons (Egypt) for various reasons.

“Logistics is a key factor that has hindered the increase in mandarin supplies from North Africa to the region, as during the peak demand period, the Red Sea was blockaded by Yemeni Houthis. Nevertheless, the future prospects for Egypt and Morocco in Southeast Asia are very promising. For instance, in 2022, access for Egyptian citrus fruits was opened in the Philippines, and a similar decision for Thailand is expected in 2025-2026,” adds Hajer Magdy.

On August 7, the team of the FAO/EBRD project “Food Security Package SEMED – Diversifying and adding value to export markets” will conduct a special online training titled “Navigating the Southeast Asian Fruit & Vegetable Market: Opportunities for Egypt and Morocco”. The detailed training program and registration form for exporters are available via the link.

“The mandarin market in Southeast Asia is not only about China, Pakistan, and Southern Hemisphere countries. Both Egypt and Morocco have excellent opportunities to capture much larger market shares than they currently hold. Exporters from both countries have extensive experience in premium markets in Europe and North America and can offer competitive price-quality ratios for mandarins and many other products,” says Yevhen Kuzin.

Buyers from Southeast Asia will be able to explore the variety of offerings from Moroccan and Egyptian exporters during Asia Fruit Logistica exhibition (Hong Kong, September 4-6, 2024). The project team has planned a series of activities, including a special session during Asia Fruit Congress and direct negotiations between importers and suppliers. Detailed information about the events and the registration form for buyers are available here.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.