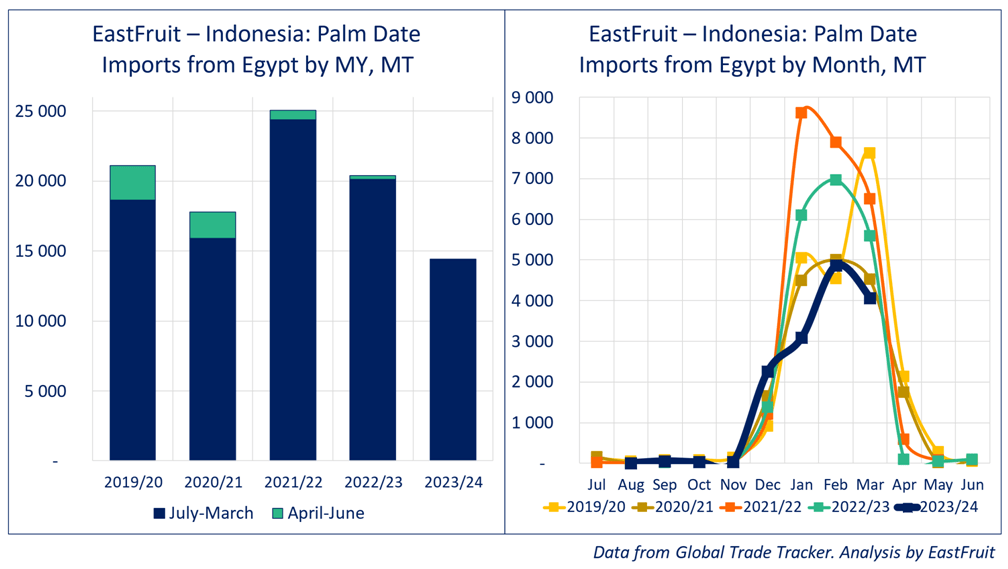

According to EastFruit, Indonesia has markedly reduced its date imports from Egypt during the first nine months of the 2023/24 season (July-March). However, Egyptian date exporters continue to be the leading suppliers to the Indonesian market.

Between July 2023 and March 2024, Indonesia’s date imports from Egypt amounted to just under 15,000 tons, a reduction of over 25% compared to the same timeframe in the previous season. Given the near absence of Egyptian date supplies to Indonesia in April and May, it is apparent that this season may be the least successful for Egyptian exporters to Indonesia in recent history.

Read also: Egypt might flood the global dates market within the next five years

The primary cause of this decline is the Red Sea blockade by Yemeni Houthi forces, a situation reflected in the Indonesian import statistics. While December 2023 saw record levels of date imports from Egypt, the figures plummeted to an all-time low in January due to intensified attacks on civilian vessels in the Red Sea.

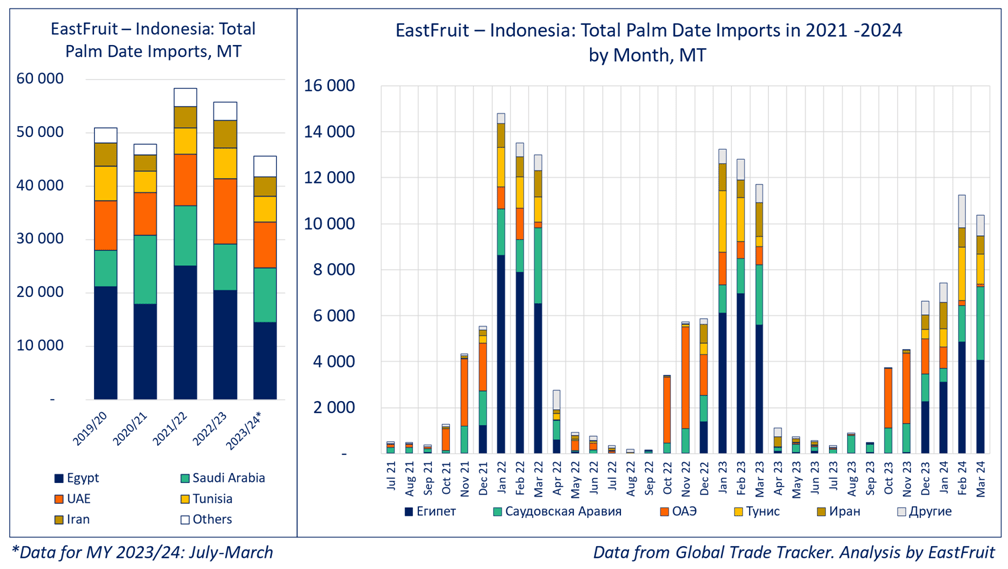

Indonesia, home to the world’s largest Muslim population, ranks as the eighth-largest importer of dates by volume and the sixth-largest in monetary terms. The country imports an average of 50,000 to 60,000 tons of dates each season.

Indonesia, home to the world’s largest Muslim population, ranks as the eighth-largest importer of dates by volume and the sixth-largest in monetary terms. The country imports an average of 50,000 to 60,000 tons of dates each season.

Egypt retains its top spot in the supplier rankings for Indonesia, followed by Persian Gulf nations such as Saudi Arabia and the UAE. Notably, Saudi Arabia has surpassed its entire previous season’s import volume (10.3 thousand tons) in just the first nine months of the current season. Tunisia and Iran typically hold the fourth and fifth positions, while other notable suppliers include Libya, Algeria, Iraq, the USA, Palestine, and Pakistan.

Date imports in Indonesia generally increase in October with the arrival of products from Saudi Arabia and the UAE. Egypt, Tunisia, and Iran contribute to the market by December, with imports peaking from January to March, a period dominated by Egypt. Import volumes then decline sharply in April and reach their lowest levels during the summer months.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.