Despite being a city-state, Singapore is one of the most important trade hubs in global trade, including fruits and vegetables. In 2023, Singapore’s annual imports of fresh fruits and vegetables exceeded $1.1 billion, making the country the 30th largest importer of these products in the world. In East and Southeast Asia, only China, Hong Kong, Japan, Indonesia, Malaysia, and South Korea imported more than Singapore. However, when comparing the population of Singapore with these other countries, it turns out that Singapore is one of the leaders in per capita imports of fresh fruits and vegetables in Asia.

In February, our team visited several key supermarket chains in Singapore to observe the fresh fruit and vegetable retail landscape firsthand. Here are our brief findings from our store check.

Generally, the fruit and vegetable departments looked well-maintained, with good air conditioning and cleanliness. The quality of fresh produce was mostly high, although there were some exceptions.

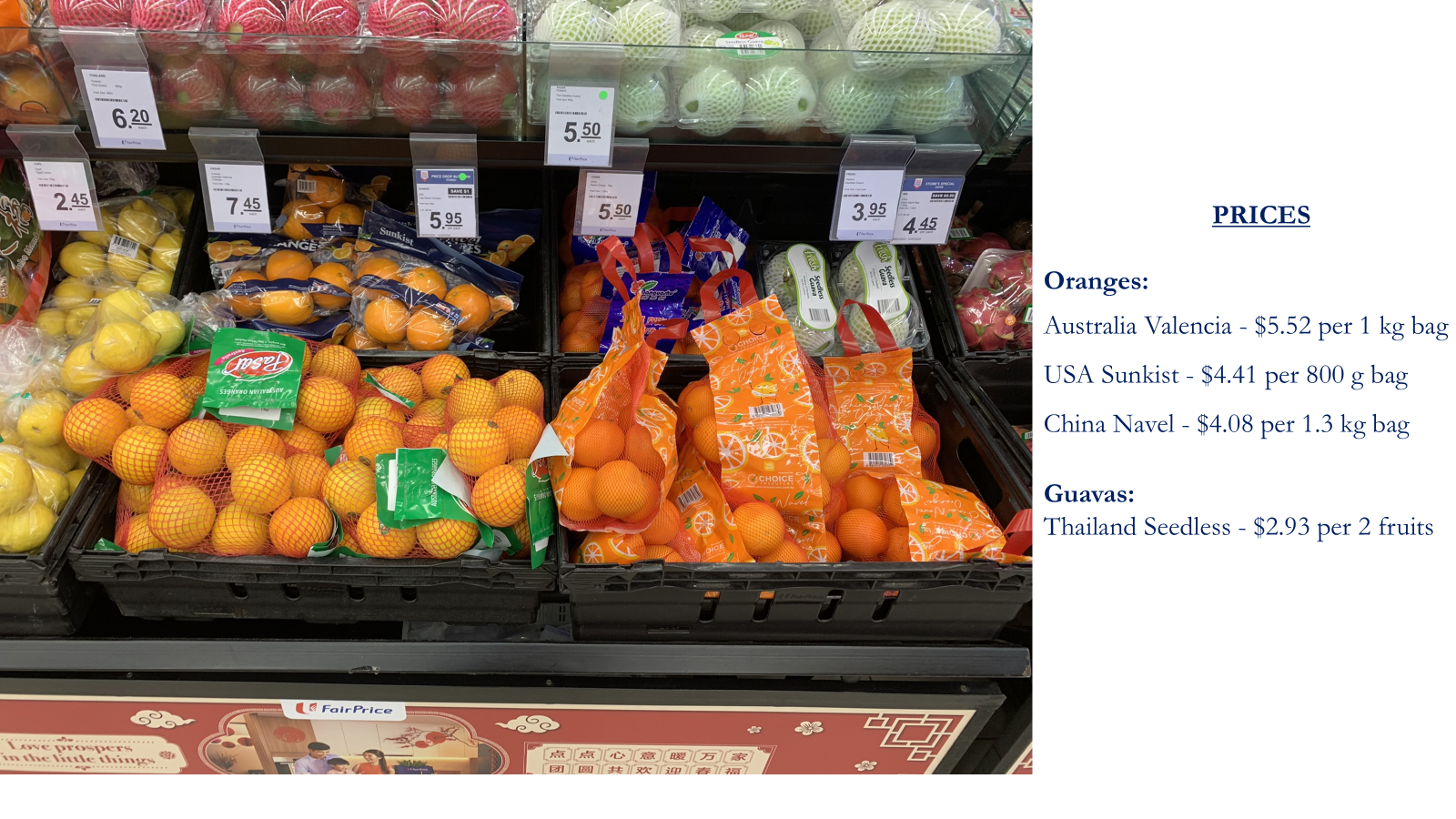

Apples and oranges usually took the lead and occupied the largest amount of space among fruits on the shelves in Singaporean stores, although their space was sometimes comparable to promoted categories, such as bananas or tropical fruits.

Both apples and oranges were most often priced per unit, and oranges were frequently offered in bags or gift boxes. Similar gift boxes were available with mandarins. Although the main festivities connected with Chinese New Year had already passed, supermarkets, especially those focused on Singapore’s Chinese community, kept some gift box options on their shelves.

Both apples and oranges were most often priced per unit, and oranges were frequently offered in bags or gift boxes. Similar gift boxes were available with mandarins. Although the main festivities connected with Chinese New Year had already passed, supermarkets, especially those focused on Singapore’s Chinese community, kept some gift box options on their shelves.

Similarly, department stores in Singapore’s Chinatown retained their decorations, as well as orange and mandarin offerings in local supermarkets, due to their importance in Chinese culture.

Similarly, department stores in Singapore’s Chinatown retained their decorations, as well as orange and mandarin offerings in local supermarkets, due to their importance in Chinese culture.

Traditions indeed play an important role among Southeast Asian communities, and the fruit and vegetable trade is no exception. Despite losing its role as the world’s top exporter of apples almost two decades ago, France is still considered a quality supplier of fresh apples to Singapore and occupies a considerable part of the space on supermarket shelves.

Traditions indeed play an important role among Southeast Asian communities, and the fruit and vegetable trade is no exception. Despite losing its role as the world’s top exporter of apples almost two decades ago, France is still considered a quality supplier of fresh apples to Singapore and occupies a considerable part of the space on supermarket shelves.

Read also: Trade mission to Singapore & Malaysia for fruit and vegetable exporters from Morocco: April 2025

Other key suppliers of apples include the US, Australia, New Zealand, and China.

Other key suppliers of apples include the US, Australia, New Zealand, and China.

Although the prices for Australian apples seemed rather high, this is because they were taken at Little Farms, one of Singapore’s premium supermarket chains. The area of their store was not large and looked like a trade corner at a large department store, but the supermarket seemed like a very decent sales point for a premium selection of foods.

Meanwhile, Chinese apples were often offered in a separate section on supermarket shelves, often together with Chinese pears.

Meanwhile, Chinese apples were often offered in a separate section on supermarket shelves, often together with Chinese pears.

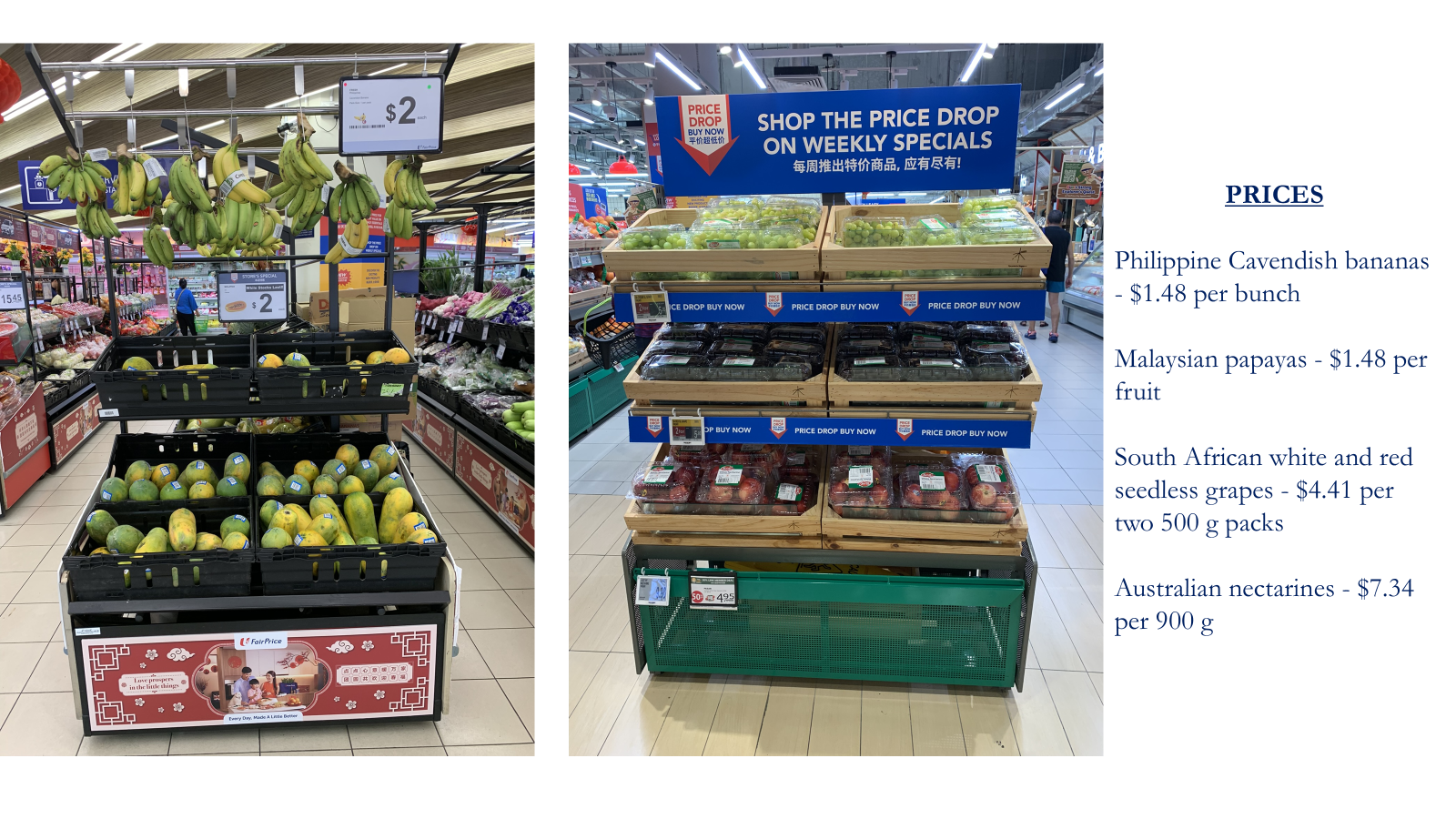

Mangoes, papayas, bananas, as well as grapes and stone fruits, were the focus of promotions during the period of our store check in Singapore.

Mangoes, papayas, bananas, as well as grapes and stone fruits, were the focus of promotions during the period of our store check in Singapore.

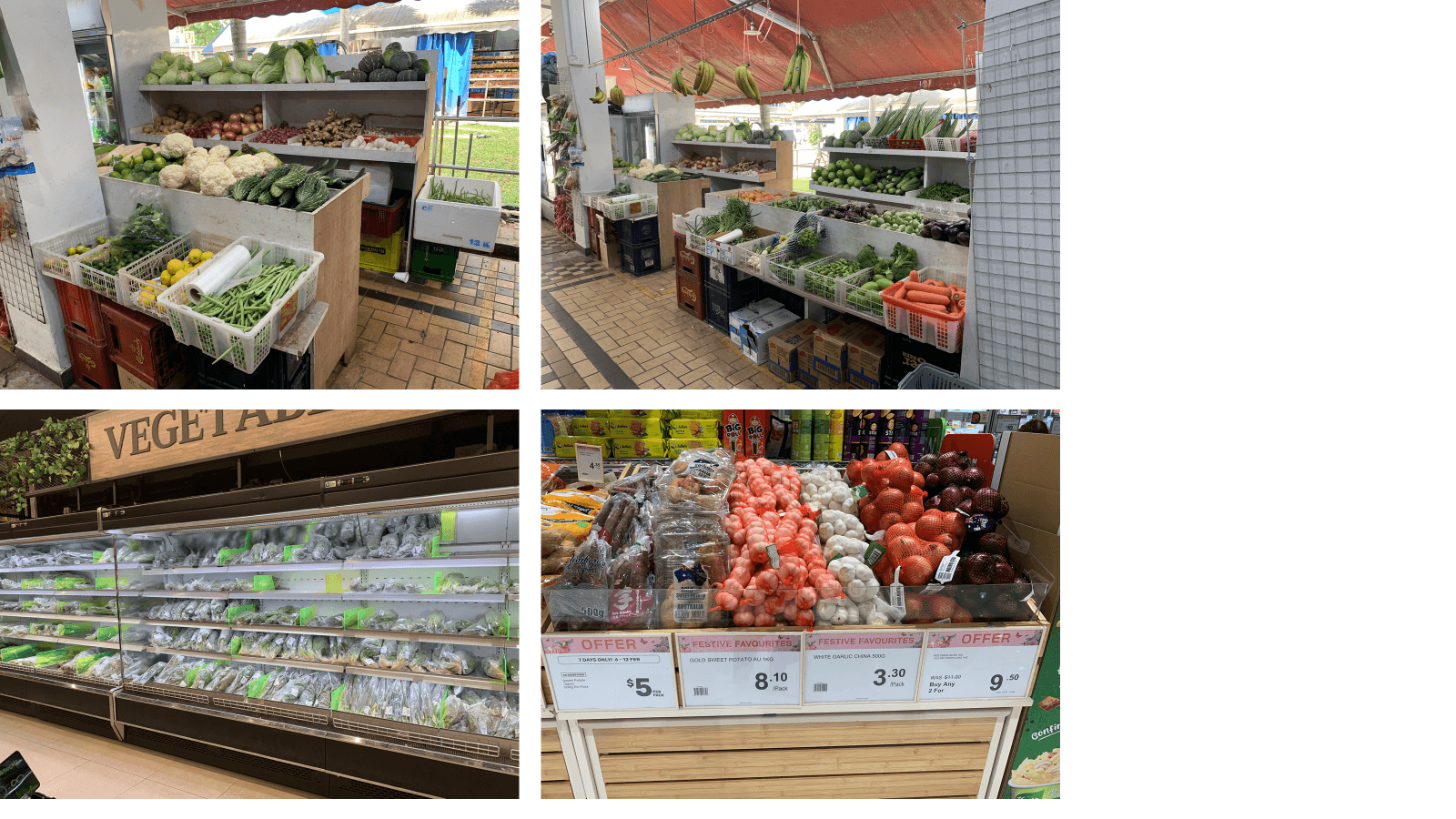

For mangoes and papayas, and several other products, buyers had the option of purchasing them at fruit and vegetable kiosks or open markets, which were often located near supermarkets. Traders were friendly and not only allowed photos of their stands but often wanted to be in the photo with their products.

For mangoes and papayas, and several other products, buyers had the option of purchasing them at fruit and vegetable kiosks or open markets, which were often located near supermarkets. Traders were friendly and not only allowed photos of their stands but often wanted to be in the photo with their products.

Another alternative included ethnic supermarkets and small shops, which specialized in Thai, Indian, or other foodstuffs.

Another alternative included ethnic supermarkets and small shops, which specialized in Thai, Indian, or other foodstuffs.

Interestingly, they applied their own approaches to produce handling, and, for example, dried fish was displayed alongside fresh ginger and onions in Thai supermarkets.

Interestingly, they applied their own approaches to produce handling, and, for example, dried fish was displayed alongside fresh ginger and onions in Thai supermarkets.

Open kiosks also seemed to be the only option to try durians, which are currently the global leader in fresh fruit trade annual volume growth rates.

In turn, supermarkets tried to offer their consumers some refreshing items during hot tropical days, such as ready-to-drink coconuts and fresh-cut melons, watermelons, and papayas.

Interestingly, supermarkets’ offerings of vegetables were comparable to or often more extensive than those at kiosks and open trade points.

Interestingly, supermarkets’ offerings of vegetables were comparable to or often more extensive than those at kiosks and open trade points.

Supermarkets also dedicated significant shelf space to fresh greens, leafy vegetables, lettuces, and herbs. Sometimes, their aisles could take up to 20% of the total area of the fruit and vegetable department.

Supermarkets also dedicated significant shelf space to fresh greens, leafy vegetables, lettuces, and herbs. Sometimes, their aisles could take up to 20% of the total area of the fruit and vegetable department.

Tomatoes also played an important role in fresh vegetable offerings, and this segment provided the most premium opportunities among vegetables in Singapore. Although the shelves were loaded with premium tomato types from Australia, the Netherlands, Spain, Belgium, etc., suppliers from Thailand and especially Malaysia were also present, usually at much lower prices.

Tomatoes also played an important role in fresh vegetable offerings, and this segment provided the most premium opportunities among vegetables in Singapore. Although the shelves were loaded with premium tomato types from Australia, the Netherlands, Spain, Belgium, etc., suppliers from Thailand and especially Malaysia were also present, usually at much lower prices.

As for the mass-market segment of vegetables, the quality of Thai and Malaysian tomatoes was often not high – tomatoes were often underripe or had mechanical injuries.

As for the mass-market segment of vegetables, the quality of Thai and Malaysian tomatoes was often not high – tomatoes were often underripe or had mechanical injuries.

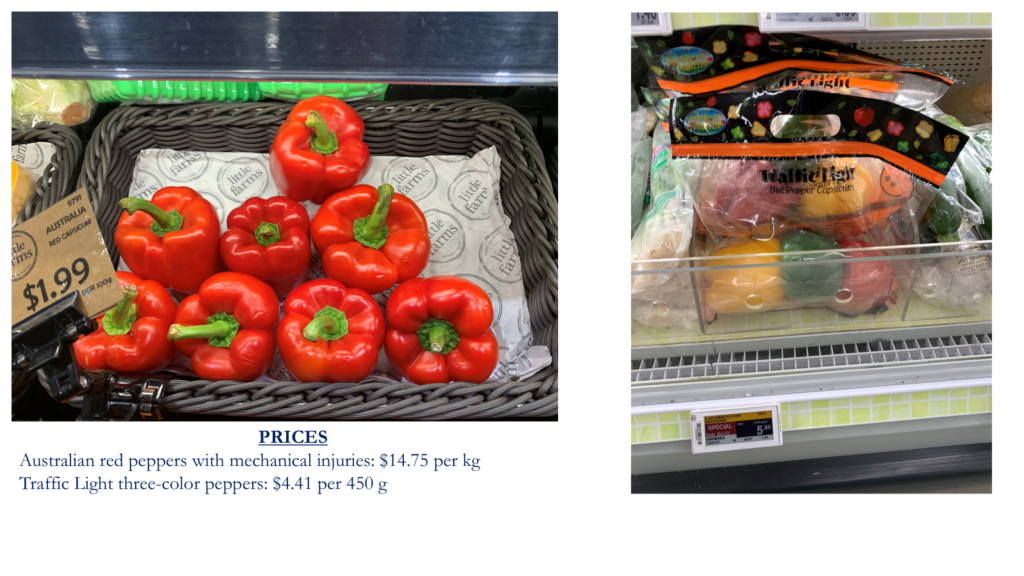

The same was true for the bell pepper segment, where even premium stores offered non-premium bell peppers at considerably high prices. Niche opportunities for bell peppers included bi- or tri-color offerings and mini peppers.

Other important vegetable categories included aubergines, squashes, onions, and garlic supplied by India, Malaysia, Indonesia, Japan, China, etc.

Other important vegetable categories included aubergines, squashes, onions, and garlic supplied by India, Malaysia, Indonesia, Japan, China, etc.

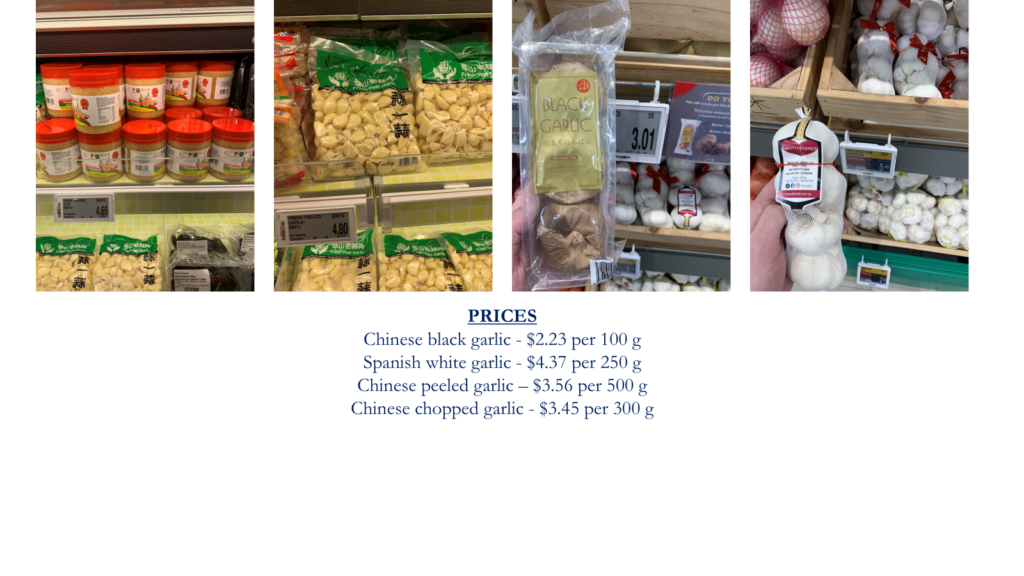

In the garlic segment, premium opportunities were present either in processed products or niche segments, like garlic from Spain.

In the garlic segment, premium opportunities were present either in processed products or niche segments, like garlic from Spain.

Meanwhile, potatoes were offered from Asian countries or Australia, but the premium segment was targeted by the USA. Notably, Asian-sourced potatoes were often offered dirty, often packed in nets. Both onions and potatoes from Asia were sometimes marked as ‘Holland potatoes’ or ‘Holland onions,’ emphasizing their quality.

Meanwhile, potatoes were offered from Asian countries or Australia, but the premium segment was targeted by the USA. Notably, Asian-sourced potatoes were often offered dirty, often packed in nets. Both onions and potatoes from Asia were sometimes marked as ‘Holland potatoes’ or ‘Holland onions,’ emphasizing their quality.

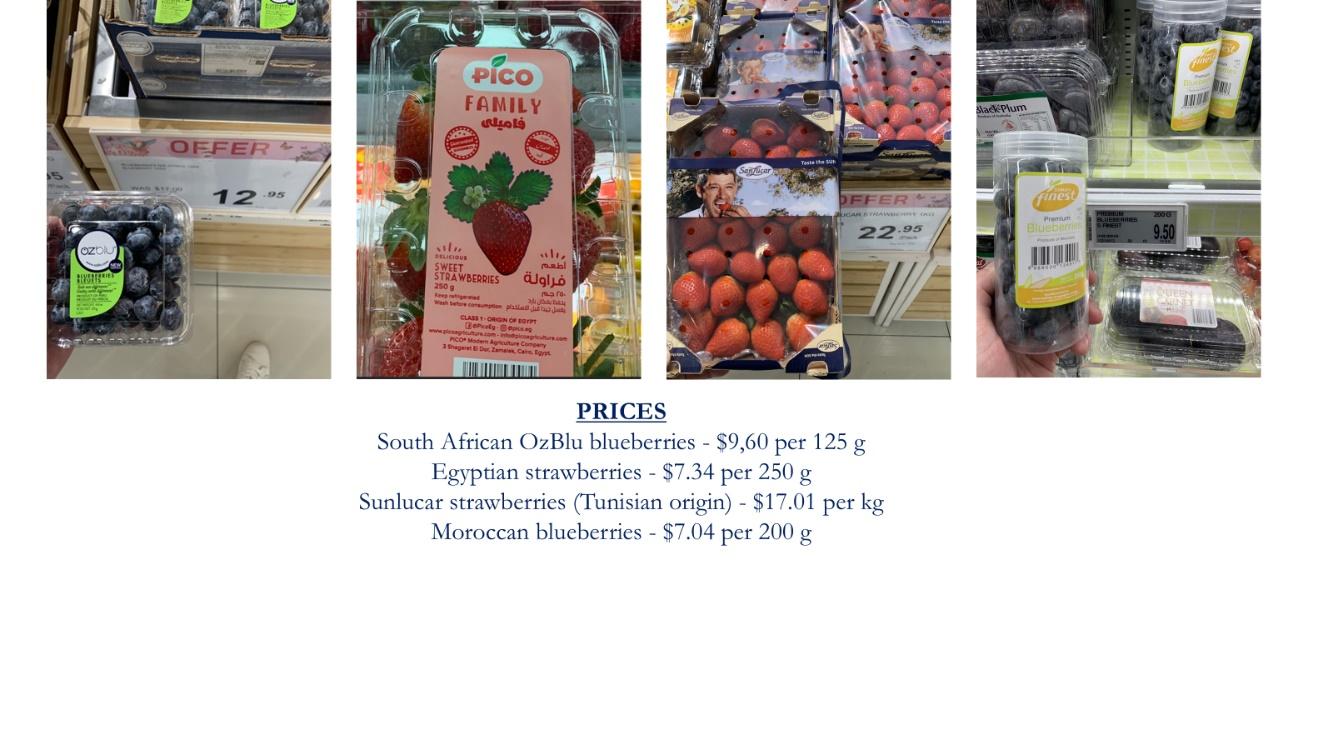

And of course, the most premium opportunities were offered in the fresh berry segment, which is currently on a rapid rise in Southeast Asia. Strawberries and blueberries were the most popular berry categories, while offerings of raspberries and blackberries took much smaller space on the shelves.

![]()

South Korea was the main supplier of fresh strawberries, although some supermarkets offered gift boxes of Tunisian strawberries, marketed by a Spanish company, or Egyptian strawberries. An important detail in the fresh blueberry, raspberry, and blackberry segment was the large share of Chinese berries, marketed by Driscoll’s, which could be an important competition factor for other suppliers. Nevertheless, most blueberries were still sourced from South Africa and Morocco.

South Korea was the main supplier of fresh strawberries, although some supermarkets offered gift boxes of Tunisian strawberries, marketed by a Spanish company, or Egyptian strawberries. An important detail in the fresh blueberry, raspberry, and blackberry segment was the large share of Chinese berries, marketed by Driscoll’s, which could be an important competition factor for other suppliers. Nevertheless, most blueberries were still sourced from South Africa and Morocco.

Notably, the rapid development of the frozen fruit segment in Southeast Asia resulted in berries being offered for sale not only fresh but also frozen. Furthermore, some supermarkets had freeze-dried raspberries available for consumers, making this option the most expensive (almost $140 per kg). Other dried categories included dried avocado chips and puffs of cauliflower or broccoli.

Notably, the rapid development of the frozen fruit segment in Southeast Asia resulted in berries being offered for sale not only fresh but also frozen. Furthermore, some supermarkets had freeze-dried raspberries available for consumers, making this option the most expensive (almost $140 per kg). Other dried categories included dried avocado chips and puffs of cauliflower or broccoli.

Palm dates, another fruit segment related to dried fruits, showed interesting trends. The visited stores of FairPrice or Cold Storage retail chains did not have palm dates on their shelves. Meanwhile, Giant supermarket not only had them but also organized several promotion stands for dates. This could be connected to the specific district of Singapore where a certain store is located.

As dates have special importance for the Muslim population, their presence on the shelves could be linked to this factor. Furthermore, an ethnic store near the visited Giant supermarket also offered palm dates.

In addition, both FairPrice and Cold Storage, and, of course, Scarlett supermarket chain, which specializes in Chinese products, had a special area dedicated to dried fruits from China, including dried fruits marketed as ‘red dates’ or ‘Chinese red dates’ at considerably lower prices. However, these dates are not actually palm dates but jujubes, which could mislead an untrained consumer.

In addition, both FairPrice and Cold Storage, and, of course, Scarlett supermarket chain, which specializes in Chinese products, had a special area dedicated to dried fruits from China, including dried fruits marketed as ‘red dates’ or ‘Chinese red dates’ at considerably lower prices. However, these dates are not actually palm dates but jujubes, which could mislead an untrained consumer.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.