Southeast Asia may soon become a new export market for one of Egypt’s most unexpected fruits – mangoes, according to EastFruit. This sounds unreal, given that the region is home to at least five well-known mango producers and net exporters: Vietnam, the Philippines, Taiwan, Thailand, and Indonesia, the latter being the second-largest mango grower globally! Nevertheless, some markets in Southeast Asia could become promising destinations for Egyptian mango exports, which are now actively developing in other regions such as Europe or Middle East.

“Despite Southeast Asia being a key global exporter of mangoes, the region also imports a significant quantity of these fruits. Malaysia, Hong Kong, Singapore, and Thailand are among the top 20 largest global importers. Most imports are intra-regional, with China and India also contributing, leaving a smaller share for other countries. However, even a small portion of the total annual volume, which can reach up to 150,000 tonnes, represents a substantial opportunity and a promising new market niche,” comments Yevhen Kuzin, Fruit & Vegetable Market Analyst at EastFruit.

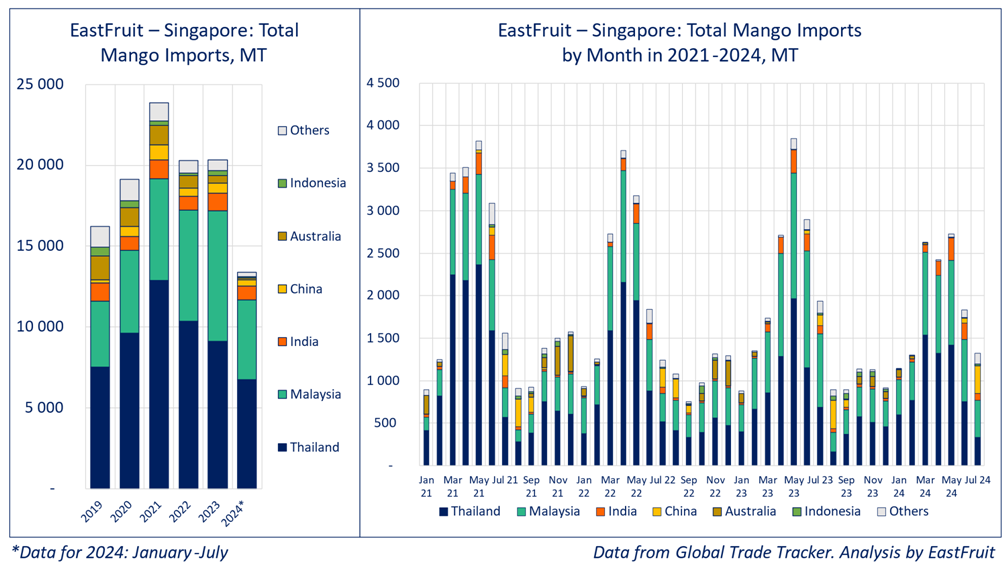

For instance, Singapore alone imports 20,000-25,000 tonnes of mangoes annually, with Thailand and Malaysia accounting for 80-85% of the total imports through both locally grown and re-exported volumes. Other less significant suppliers include Asian countries such as India, China, Indonesia, Myanmar, Pakistan, the Philippines, Vietnam, and Taiwan, as well as Australia. Australia primarily supplies the Singaporean market in autumn and the first half of winter, while Asian suppliers provide a year-round supply, peaking from March to June.

“Targeting the market in Singapore or other Southeast Asian countries will undoubtedly present tough competition for Egyptian suppliers, given the presence of local growers and suppliers from nearby countries. Therefore, the traditional Egyptian strategy of selling large volumes of mass-market varieties at low prices is not viable in this case. Instead, focusing on the so-called super-mangoes, which are largely unknown to consumers outside Egypt, can target the premium market segment, thus avoiding direct competition with the majority of suppliers,” explains Yevhen Kuzin.

Egypt is home to more than 200 mango varieties, most of which are unknown globally. Egyptian exporters typically use only a few varieties, chosen for their transportability rather than their taste and flavor. However, other lesser-known local varieties can be considered ‘super-mangoes’ due to their exceptional sweetness, distinct flavor, aroma, and taste.

“Airfreighting these local sweet super-mangoes to destinations such as Singapore, Hong Kong, or Malaysia presents a valuable opportunity for Egyptian exporters focusing on high-value exports. Currently, the domestic wholesale price for Egyptian mangoes ranges from $0.25 to $0.90 per kilogram. When combined with air freight logistics costs to Singapore of about $1.20 per kilogram, this creates an ideal opportunity for targeting the premium segment in the region. Moreover, it eliminates maritime logistics risks associated with the Red Sea blockade and allows Egyptian exporters to surpass competition from mass-market suppliers, whether regional or from countries like Pakistan or China,” concludes Yevhen Kuzin.

Detailed information about the export opportunities for Egyptian fruits and vegetables in Southeast Asia will be presented at a special session of the Asia Fruit Congress during Asia Fruit Logistica on September 6. Exhibition visitors will also have ample opportunities to secure the best produce deals with Egyptian exporters throughout the three-day trade show in Hong Kong.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.