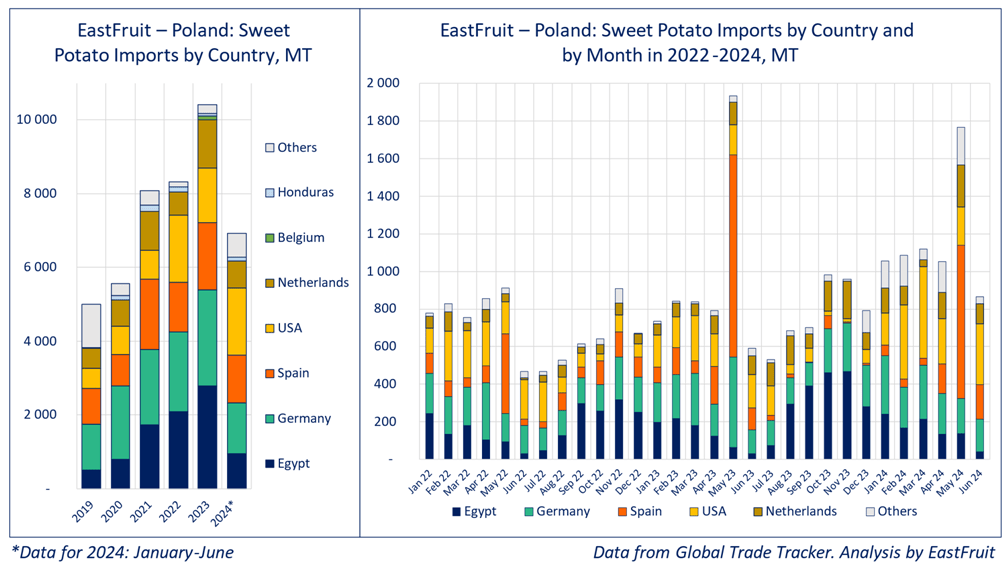

Egypt has ascended to the top of the list of sweet potato suppliers to Poland in 2023, with strong prospects to further solidify its market position this year, according to EastFruit. Last year, Egyptian exporters directly sold 2.8 thousand tons of sweet potatoes to Poland, surpassing the 2022 figure by one-third. Additionally, from January to June this year, sweet potato imports from Egypt to Poland reached a record 940 tons for this period.

“Poland is already the fifteenth largest importer of sweet potatoes globally. Moreover, considering that many top-listed countries import this product for re-export, Poland’s position in the global ranking of sweet potato consumers is even more significant. Over the past five years, Poland has more than doubled its imports of this product, a growth rate matched only by the USA, which uses a significant portion of imports for re-export,” comments Yevhen Kuzin, Fruit & Vegetable Market Analyst at EastFruit.

Egypt has become a key driver of the rapid increase in sweet potato imports to Poland. From 2019 to 2023, imports of Egyptian sweet potatoes to the Polish market increased nearly sixfold. Meanwhile, imports from Spain to Poland increased by only 90% over the same period, and purchases from the USA tripled. A significant share of the Polish market is still occupied by Germany and the Netherlands, which supply previously imported volumes from Spain, the USA, and Egypt.

Read also: Egypt finally leads EU sweet potato supply rankings, surpassing USA

In recent years, Eastern Europe has emerged as one of the most attractive markets for sweet potato exports. From 2019 to 2023, for example, Ukraine increased its imports of this product almost fourfold, Romania nearly tripled its imports, the Czech Republic almost doubled its imports, and in Slovakia, volumes grew from 500 to 7 thousand tons. Nevertheless, the share of direct supplies from major exporting countries remains relatively small in this region.

“In the coming years, two trends will dominate the sweet potato market in Eastern Europe. Firstly, imports will continue to grow, as the consumption potential of this superfood in the region has not yet reached its peak. Secondly, the share of direct supplies from new supplier countries, such as Egypt and, to a lesser extent, Morocco, will increase,” concludes Yevhen Kuzin.

We remind suppliers of sweet potatoes and other products interested in Eastern Europe to join the online training “Navigating the Eastern European fresh produce market. Opportunities for Egypt and Morocco” on October 1. Additionally, they can participate in the trade mission of Egyptian and Moroccan exporters to Warsaw in November. Details of the trade mission will be published later, so stay tuned for updates on the website www.east-fruit.com.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.