According to EastFruit analysts, the watermelon market in Uzbekistan and Central Asia is currently facing significant challenges. Producers are reporting a lack of demand, leading many to leave their watermelons unharvested in the fields. Some have resorted to harvesting watermelons solely to feed them to livestock, as highlighted in a video from the local Telegram channel Agrobloger.

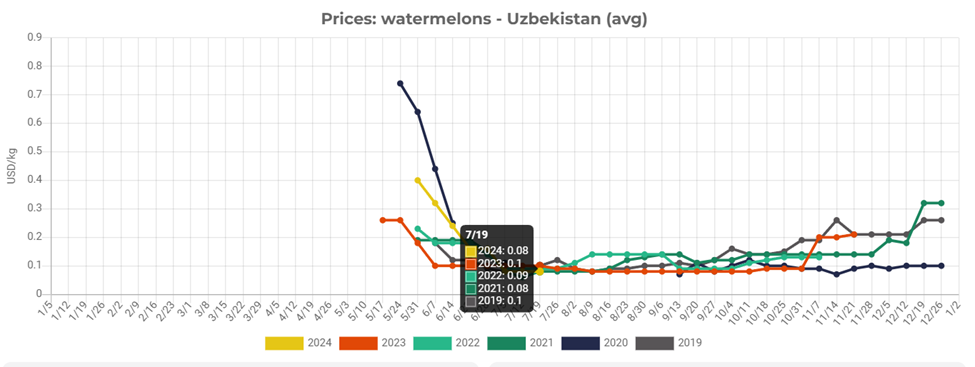

EastFruit’s wholesale price monitoring indicates that small wholesale prices for fresh watermelons in the Uzbek market have plummeted to a record low of 8 cents per kilogram. This price applies to watermelons that have already been selected, delivered to the market, and displayed for sale. At any lower price, trading watermelons becomes unprofitable.

A major factor contributing to the price collapse and the near-total lack of demand for watermelons in Uzbekistan is the unprofitability of exporting them to the primary market, Russia. In Russia, watermelon prices have also dropped to record lows, with the current wholesale price roughly equal to the cost of transporting them from Uzbekistan.

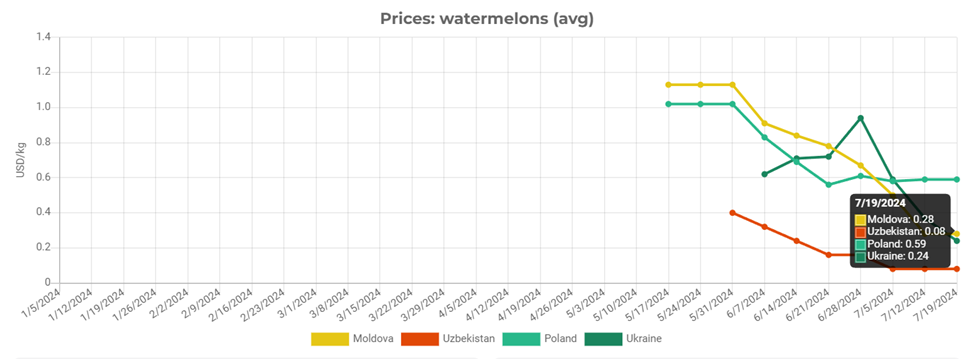

“Exporting watermelons to Eastern European and EU countries from Uzbekistan this season is challenging due to similarly low prices in these regions. For instance, Ukrainian farmers experienced an overproduction of watermelons and a price collapse even before the mass harvesting season began. Consequently, the price difference between watermelons in Ukraine and Uzbekistan does not cover transportation costs. Moreover, EU countries find it more economical to purchase cheap watermelons from Ukraine than to import them from Uzbekistan,” explains Andriy Yarmak, an economist at the investment department of the Food and Agriculture Organization of the United Nations (FAO).

Bakhtiyor Abduvokhidov, an international fruit and vegetable business expert, notes that the situation in Tajikistan is comparable. “Small watermelons are being given away for free to anyone who wants them, while larger ones can still be sold, albeit at a reduced price,” says Mr. Abduvokhidov.

Bakhtiyor Abduvokhidov, an international fruit and vegetable business expert, notes that the situation in Tajikistan is comparable. “Small watermelons are being given away for free to anyone who wants them, while larger ones can still be sold, albeit at a reduced price,” says Mr. Abduvokhidov.

Some market participants speculate that prices for quality watermelons may recover slightly in Eastern European countries in the near future due to abnormally hot weather, which could lead to crop loss or quality reduction. However, there is also a contrary opinion that the mass harvesting of watermelons, set to begin in 2-3 weeks, may further depress prices in the Ukrainian market.

Maintain full control over fruit and vegetable prices in Turkey, Egypt, Ukraine, Uzbekistan, Russia, Moldova and other markets subscribing to EastFruit Premium.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.

2 comments

If we in the Uzbekistan market ease the challenges of delivery to the EU market, it might not only cost less for EU consumers but also become profitable for Uzbek harvests. As we know, the quality of watermelons in Uzbekistan is much better compared to that of many countries’ watermelons.

Quality – is a very subjective thing. People think of quality based on their taste preferences and other preferences too. For example, huge melons and watermelons you have in Uzbekistan is a no-go product in the EU – people don’t need large sizes. They prefer something within 2-3kg range, preferably less than 2. Also, if the product is too sweet, it will not sell in some countries as local consumer prefer a different taste. Also, you are far away and it is hard to reduce the already low transportation costs. If you follow the rules of the EU while shipping, it would cost more.