The 2022/23 season has been very difficult for freezers, which will have a lot of adverse consequences for the new season. EastFruit experts have described these problems in detail in such material as: “The market for frozen fruit and vegetables: why buyers are silent” or “Review of the EU frozen raspberry market – will the free fall in prices stop?”.

These circumstances will most likely have a very significant impact on market trends in the upcoming season. Let’s assess what the consequences may be, and how this will affect the market size and prices for frozen fruits and berries in the 2023/24 season.

Financial difficulties of frozen fruit and berry producers

“There is no money, and the new season is already very close. How would we buy raw material, cover the current costs and salaries?” These questions are very common among freezers in Europe.

Financial losses due to the market decline in the outgoing season have led to the fact that many freezers do not have enough cash to start the new season. Moreover, until now, European traders have debts to freezers and freezers haven’t fully paid to growers. These debts are yet to be covered somehow.

This crisis is not unique for the fresh produce freezing industry and has affected many areas. The banking system is no exception. Therefore, obtaining additional credit from the banks may not be a way out of a difficult financial situation. Firstly, many companies already have unpaid loans, and banks may not agree on new ones. Secondly, the interest rates have increased significantly over the year, which will certainly affect the company cost and, possibly, make it economically inexpedient to purchase certain types of fruits and berries for freezing.

Many farmers in the fruit and vegetable sector do not use loans, so not everyone understands how much the cost of money affects businesses where funds are frozen for a long time. Fruit and berry freezers are not only freezing the produce but also freezing the money for a long time as most of the sales occur several months after the end of the season. The higher the value of money, the lower the price a freezer can pay a farmer for his raspberries, strawberries, plums, apricots, cauliflowers, or other raw materials.

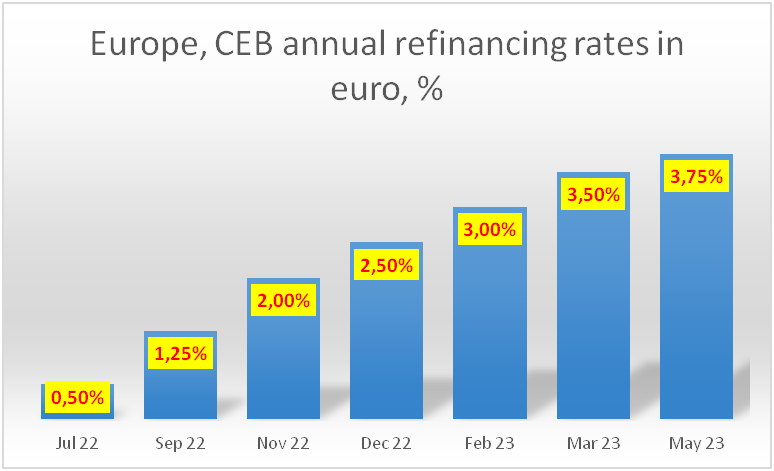

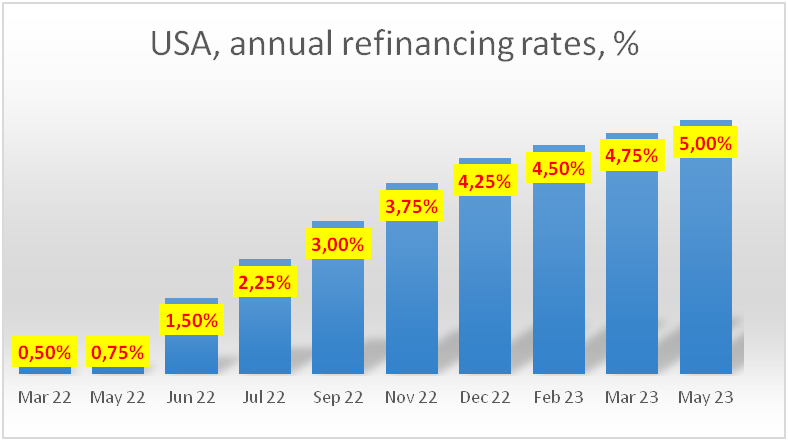

To explain this in hard numbers let’s take a look at the dynamics of the refinancing rates of the European Central Bank, which directly affects the cost of loans in euros and the US Federal Reserve’s rates in dollars from the beginning of the 2022/23 season until today.

As you can see from the chart above, since July 2022, the euro refinancing rate has increased by 7.5 times! Prior to that, it has not changed since 2019 and was at the level of 0%!

In US dollars the situation is even worse – since March 2022, the Federal refinancing rate has increased 10 times!

In US dollars the situation is even worse – since March 2022, the Federal refinancing rate has increased 10 times!

Consequently, in order to buy raw materials and start the season, the producers of frozen fruits and vegetables need money. If money is expensive, then the processor must either reduce the purchasing price of raw materials or expect an increase in the price of final products. And, as we have already shown in the publications mentioned at the beginning of this article, the prices for all types of frozen fruit and berry have fallen sharply over the past season. Therefore, even without an increase in the cost of attracting loans, the freezers would have had to reduce the prices of raw materials this season anyway.

It is natural to assume that farmers will not want to sell products cheaper than a year earlier, if, of course, they have a choice in the form of alternative markets. It is also logical to assume that the volumes of purchases of raw materials by freezers may decrease. Time will tell, however, for now, both factors are negative in terms of commodity price outlook.

Unsold stocks of frozen produce

It is no secret that freezers and traders have significant unsold stocks of frozen produce from 2022. This factor is also very negative, first of all from the financial point of view, and secondly from the logistical point of view.

Frozen unsold products are, in fact, frozen cash. Freezer spent money to buy raw materials, spent money to freeze and package it, spent money to store it in a low-temperature storage facility and continues to spend money now on storage without an understanding of when and for what price this product will be sold. The money has been frozen for nearly a year now and the cost of raw materials continues to grow. By the way, do not forget that this frozen money also has a value, because bank interest is added each day, and this money must be paid back.

Where, in this case, freezers will get money for the purchase of raw materials in the new season and its processing?! Well, this is a financial aspect, and there is also a logistical one, which is also yet another negative factor.

Together with frozen funds, unsold stocks of frozen produce also take up space in the storage facility, which means there is less space for products to be produced in 2023. This means that the freezers are forced to plan a reduction in the processing volume.

What are the reasons why certain products are still in stock. What is the size of the market for these products, considering the drop in demand, and should freezers even consider processing again in 2023 something that was not in the demand during the whole year?

These factors lead producers to indecision in plans regarding the procurement of products for the new season. If freezers offer low prices and deferrals with payments – the season may be missed, or production capacities will be underutilized. For freezing enterprises, the maximum capacity utilization is one of the most important factors in the economic feasibility.

These factors lead producers to indecision in plans regarding the procurement of products for the new season. If freezers offer low prices and deferrals with payments – the season may be missed, or production capacities will be underutilized. For freezing enterprises, the maximum capacity utilization is one of the most important factors in the economic feasibility.

Freezers are now actively collecting information on the expected yield of fruits and berries in various countries. That is why the market for frozen apricots and stone fruits in general saw some increase in demand recently on the background of rumors about a poor harvest in Europe.

Market participants are also actively discussing the situation with berries, in particular, with the stocks of raspberries and wild blueberries in warehouses. Everyone keeps their finger on the pulse trying to quickly react to incoming information.

The 2023/24 season will be another period of uncertainty and adjustment to a rapidly changing market. Today, it is the purchasing power of the end customer that dictates the vector of market movement and so far, it is not very good.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.