The treacherous attack of a huge russian army on Ukraine on February 24, 2022 threatened the food security of Uzbekistan and many other countries globally, impacting the already fragile global balance of food supplies. The government of Uzbekistan manages to cope with emerging threats so far, but the main challenges are yet to come.

In this article, we will outline the situation with food security, macroeconomic and financial stability, as well as consumer sentiment in Uzbekistan and try to assess the prospects and options for future developments.

Uzbekistan is a net importer of food items. The negative trade balance is about $500 million per year.

At the same time, 36% of imports are direct deliveries of food from countries that are directly involved in the war. About 30% of Uzbekistan’s food is imported from the russian federation, 4% from belarus and about 2% from Ukraine. The data on the supply of food from russia to Uzbekistan may even be underestimated, as some of the goods enter the country through intermediaries from Kazakhstan.

In exports, Uzbekistan’s dependence on food supplies to these three countries is even higher – according to our estimates, it is about 42%! About 40% of food products are exported to the russian market, including volumes passing through such intermediaries as Kyrgyzstan and Kazakhstan.

Accordingly, the impact on the food market of Uzbekistan of the war in Ukraine may be huge in the long term.

The most sensitive positions of Uzbekistan’s food trade

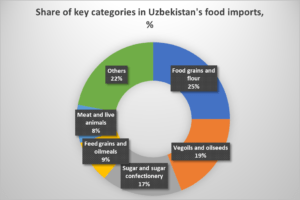

More than 60% of all food imports of Uzbekistan are high-calorie basic products, such as grain and grain products, vegetable oil and raw materials for its production, as well as sugar.

Quite sensitive to changes in the conjuncture of imports is the category of feed for livestock and, to a lesser extent, the import of meat itself. Uzbekistan is a net importer of all these goods, meaning that changes in import regimes, availability of imported goods and their prices can have a large impact on the domestic food market and food security.

The situation in Uzbekistan in terms of food security is relatively favorable only in terms of vegetables and fruits, with the possible exception of potatoes. However, there is also an issue of great dependence of the fruit and vegetable business of Uzbekistan on the supply of vegetables and fruits to the markets of russia and other countries that have close trade ties with it. Due to the sharp drop in effective demand in russia, the sharp devaluation of the local currency and the outflow of the population from the country, traders and producers in Uzbekistan urgently need to look for alternative markets. This is not an easy task, because Uzbekistan’s logistics are expensive and complicated. These products are classified as perishable, and their quality leaves much to be desired from the point of view of countries that are more demanding than russia on the quality.

However, let’s get back to the critical import categories.

In terms of grain and grain processing products, Uzbekistan’s dependence on russia is not too high – the bulk of the products are imported from neighboring Kazakhstan. Small volumes are imported from Ukraine.

There are no problems with vegetable oils either – there is no ban on exports from the russian federation, dependence on supplies from Ukraine is also minor – within 1-2%. Of course, oils and grain may rise in price, but this is a global problem.

As for sugar, the problem is quite tangible. Imports from russia accounted for more than 60% of imports of sugar and confectionery, and now there is a direct ban on exports. The share of sugar imports from Ukraine was tangible – about 4%. Accordingly, the solution to the problem could be an increase in domestic processing of raw sugar, which can be imported from Brazil and other major supplying countries, but the main question here is whether the capacities of Uzbek enterprises allow this.

The general situation in terms of imports does not look threatening, although the increase in food prices is undoubtedly causing serious concern among the population. According to analysts, the price increase may be much larger by the end of the year, as the world is still tapping into 2021 harvest stocks.

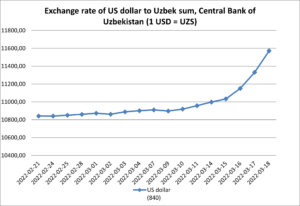

The exchange rate of the dollar and other currencies in relation to the Uzbek sum

In Uzbekistan, the exchange rate of the US dollar and other major currencies, except for the russian ruble, remained relatively stable until March 9. For example, from February 24 to March 9, the US dollar exchange rate set by the Central Bank of the Republic of Uzbekistan increased from 10 840 to 10 897 UZS per $1, that is, only 0.5%. Since the rate is set by the Central Bank, the regulator has apparently taken a wait-and-see position – the war could be short-term and then everything will return to normal. But the war dragged on, and the Central Bank began to gradually devalue the sum – from 9 to 15 March, the US dollar exchange rate increased from 10 897 to 11 033 UZS per $1, i.e. by 1.2% in a week.

However, this is a meager devaluation of the sum, given that in the second half of March and early April, the season for shipping early vegetables to foreign markets starts. The russian, Kazakh and Kyrgyz markets are the main ones, and their currencies have fallen significantly against the US dollar. In addition, shipments of dried fruits and vegetables, as well as frozen ones, continue and will continue. By that time there was an understanding that the war was entering a protracted phase, and the negotiations had not yet yielded visible results. From 15 to 18 March, the US dollar exchange rate rose sharply – from 11 033 to 11 572 UZS per $1, i.e. by 4.9% in 3 days.

Thus, from February 24 to March 18, 2022, the US dollar exchange rate in Uzbekistan increased from 10 840 to 11 572 UZS per $1, i.e. by 6.8%. But this is not enough to make Uzbek goods competitive in price in the main sales markets, where the devaluation was more significant. On the other hand, effective demand in the key sales markets, especially in russia, also fell sharply, so even with a sharp currency devaluation, it would not be easy to maintain high volumes of product exports. In addition, a sharper devaluation of the national currency of Uzbekistan could have a negative impact on inflation indicators.

Consumer sentiment in Uzbekistan and panic buying

During the audit of the stores of the supermarket chains in the capital of Uzbekistan, as well as in communication with the residents of the country, EastFruit experts did not notice any critical changes in consumer sentiment.

A short-term excitement arose due to a temporary ban on the supply of russian wheat and sugar, but the official authorities reacted almost immediately and reassured the population with statements that there would be no shortage of wheat and sugar in Uzbekistan! For example, wheat will be provided with local production plus imports from alternative suppliers, sugar will be bought from an alternative supplier – Brazil. Here is an example of a statement by the Ministry of Agriculture.

Nevertheless, there was an impact of such a ban on consumer sentiment. Some chains have introduced restrictions on the sale of sugar in one hand: in the “Basket” – 2 kg per person, “Macro” – 4 kg, but “Havas” sells 10 kg. In the Carrefour chain, people also freely buy 10 kg of sugar. The Kazakh chain “Magnum” even touted buyers during the celebration of Navruz by the fact that they had a lot of sugar at a bargain price.

Many older people made a stock of pasta, cereals and other essential products just in case, but this did not have a critical impact on the provision of stores with goods, but rather contributed to a short-term increase in sales.

Otherwise, there are no changes in consumer sentiment in the capital of Uzbekistan, including excitement or panic.

The range of food in supermarkets in Uzbekistan and the structure of crops

Changes in the range of vegetables and fruits, other food products, as well as other categories – including household chemicals, medicines and other essential goods, are currently not observed in Uzbekistan.

Similarly, no intentions to change the structure of sown areas in Uzbekistan have been noted so far. Farmers are more concerned about the impact of weather in March 2022 on their crops than any possible food shortages.

Remittances from migrants

Money transfers from labor migrants can be problematic. The impact of the war in Ukraine on the volume of cross-border transfers to Uzbekistan from labor migrants can be much more negative now than during the COVID-19 pandemic, when a large part of labor migrants “stayed at home”.

Since about 75-80% of labor migrants’ remittances come from russia (65-70%) and Kazakhstan (7-10%), the impact will have two aspects. First, the depreciation of the russian ruble automatically reduced the income of “russian” labor migrants by 25–30% in US dollars, and that of “Kazakh” migrants by about 15–18% in US dollars. Even without taking into account other factors, the devaluation of the russian ruble and the Kazakh tenge is already leading to a significant decrease in the volume of remittances from these countries.

The second point is a severe deterioration in the economic situation in russia and, as a result, in Kazakhstan, too, since the economy of the latter is closely interconnected with the russian economy. The consequences for Uzbek labor migrants are an increase in unemployment in russia, a sharp reduction in demand for foreign labor, and, most likely, a decrease in wages of migrants. All this leads to a reduction in the number of labor migrants, to a greater extent in russia and probably to a lesser extent in Kazakhstan, as well as a decrease in their income.

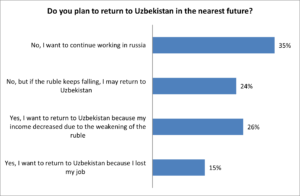

In early March, the Agency for External Labor Migration conducted an anonymous survey among labor migrants on its official Telegram channel.

The respondents were asked the question: “Do you plan to return to Uzbekistan from russia in the nearest future?“. Four response options were then offered, and the results are as follows:

As of March 18, 2022, 13 600 respondents participated in the survey.

As can be seen from the table, so far only 35% of respondents are firmly convinced to continue their work; 24% may return if the russian ruble continues to depreciate; and 41% of respondents want to return to Uzbekistan due to a sharp decrease in income due to the devaluation of the ruble or because of the loss of a job. According to various estimates, there are 1.5-2.0 million labor migrants from Uzbekistan in russia.

If we sum up these two aspects (devaluation of the russian ruble and Kazakhstani tenge + deterioration of the economic situation, first of all in the russian and then Kazakhstani economy), we can imagine how the total volume of remittances to Uzbekistan can decrease.

For your information, according to the Central Bank of the Republic of Uzbekistan, the volume of receipts through the international money transfer systems for 12 months of 2021 amounted to $8.1 billion, which is 34% more than in 2020 and 2019. According to rough estimates, 65-70% of this amount comes from russia – about $5.5 billion and 7-10% from Kazakhstan – about $650 million.

This is a serious inflow for the economy of Uzbekistan and how much it will decrease in 2022 is a big question. The first results will be visible in the 1st quarter of 2022, and the fullest effect will be seen in the 2nd quarter of 2022. Even if revenues are reduced by a third at the end of the year, which is quite likely, Uzbekistan will not immediately get $2.7 billion.

This is equivalent to the total absence of exports of fruits and vegetables from Uzbekistan for three years! Accordingly, this will seriously affect all other segments of the country’s economy.

In terms of estimates, the World Bank forecasts a 21% decline in remittances to Uzbekistan, but this forecast was released before a survey of labor migrants on plans to return to Uzbekistan from russia. Therefore, taking into account the results of this survey – that is, the current sentiment of Uzbek labor migrants, this assessment can be adjusted towards a more negative impact.

By the way, for the convenience of migrants and their relatives, all banks in Uzbekistan buy and sell the russian ruble now, since russia itself has an acute shortage of foreign currency in cash. This alleviates some of the problems, but does not solve them.

State regulation

The first measures to regulate prices are taken by the government in relation to sugar. In some regions, its prices even rose to 20 000 UZS/kg. Prices for buckwheat, which was also mainly imported from the russian federation, increased significantly.

Also, the government of Uzbekistan is now trying to intensify trade with Asian countries, in particular with Pakistan, Iran, India and China, in order to reduce trade dependence on supplies from russia. In addition to potatoes, they have already begun to buy meat from Pakistan.

We hope that this will also expand the possibilities for exporting fruits and vegetables from Uzbekistan in 2022.

Conclusions

The situation in the food market in Uzbekistan remains stable at the moment, but we should expect an increase in inflation in the country and a deterioration in the overall macroeconomic situation due to a decrease in remittances from labor migrants. Also, food prices are likely to keep rising in the coming months affecting the access of the country’s poorest residents to the minimum set of food calories. The situation may worsen if many labor migrants from russia and Kazakhstan return in the event of a job loss, as they will also want to buy a food basket that has risen in price. This will lead to the need to increase imports while reducing incomes.

There is also concern about the prospect of exporting fruits and vegetables to the markets of russia, Kazakhstan and Kyrgyzstan, where there is a decrease in the level of incomes of the population and the devaluation of local currencies. This may lead to a decrease in the income of the country’s farmers and the curtailment of investment projects in this area.

The crises with high food and energy prices, complex and expensive logistics, and the growing number of trade barriers in the world are likely to persist for several years and will have a global nature.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.