The cherry season is beginning in Eastern Europe, in Georgia it is in full swing, and in Central Asia it is already coming to an end. However, mid-June is the period of time when cherries can be found in the wholesale markets of most countries in the region, so, as usual, EastFruit offers an overview of the markets for cherries in different countries of the region.

Uzbekistan

For the second year in a row, cherry farmers in Uzbekistan are facing the consequences of bad weather. Although the 2023 harvest is higher than in 2022, when losses reached 50% of the potential harvest, it is still not as high as in 2021 despite the significant expansion of area devoted to the crop. There are also problems with the size of the cherry fruits.

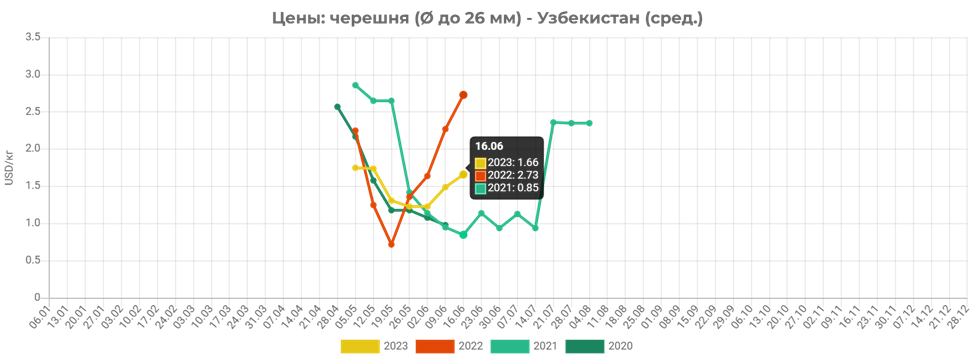

The price chart below confirms this information – medium-sized cherries are sold at $1.6-1.7 US dollars per kg in bulk, which is on average one and a half times more expensive than the usual level for this period of time.

Usually, at this time, prices for sweet cherries in Uzbekistan continue to fall or reach the bottom, but in 2023 they already started to grow a week ago, which indicates relatively small volume of products left on the market and in the orchards.

At the same time, according to our market analysts in Uzbekistan, large cherries with a size of more than 28mm are a huge rarity in the domestic market and are sold in bulk at prices ranging from $5.25 US dollars and more. Traditionally, large-caliber cherries from Uzbekistan are exported. For the local market, such a product is offered rarely, because countries buying Uzbek cherries usually have higher consumer income levels and can afford to pay a higher price for it.

Below are some photos of yesterday’s sweet cherries at the wholesale market in Tashkent.

Our YouTube-channel of EastFruit you can see two videos: 1) traditional technology of growing, picking, sorting and trading sweet cherries in Uzbekistan, and 2) modern technology of sweet cherry production, hydro-cooling and handling.

Tajikistan

“The cherry season is already over. Now farmers are harvesting cherries only in the mountainous regions of Tajikistan, but in a couple of weeks there will be nothing left. The sweet cherry harvest is noticeably lower than in previous years,” says Bakhtiyor Abduvokhidov, FAO International Consultant.

Prices for 26+ caliber cherries are about $2.5 USD per kg – this is the price of an intermediary already on the wholesale market. When delivering for exports, you must also take into account the cost of packaging, which will increase the wholesale price for cherries by another 30 cents to $ 2.8 dollars.

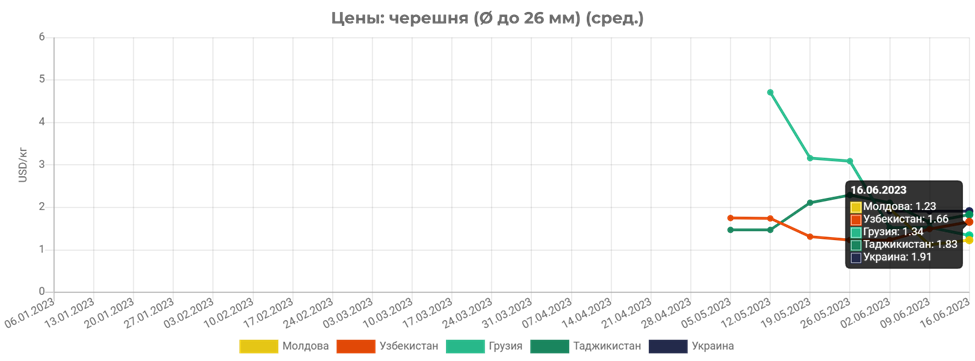

Small cherries in Tajikistan cost in bulk from $1.5 to $2 USD per kg. Those. prices for small cherries in Tajikistan are approximately the same as in Uzbekistan, but large cherries are much cheaper.

The thing is that Tajikistan exports relatively little cherries due to significant logistical difficulties and a low level of infrastructure development. With such complex logistics, it is desirable to cool cherries using hydrocooling, but there is not a single hydrocooling for cherries in Tajikistan.

According to market participants, Iranian entrepreneurs, having read on EastFruit about the reduction in prices for sweet cherries in Tajikistan, were interested in purchasing them for exports to Russia. However, logistical difficulties and lack of infrastructure prevented this. Currently, Iran is actively exporting sweet cherries to the Russian market, including re-exports through Azerbaijan.

It is interesting to note that at the moment the prices for sweet cherries in Moldova and Georgia are already lower than the prices in the countries of Central Asia despite the lower cost of logistics.

Georgia

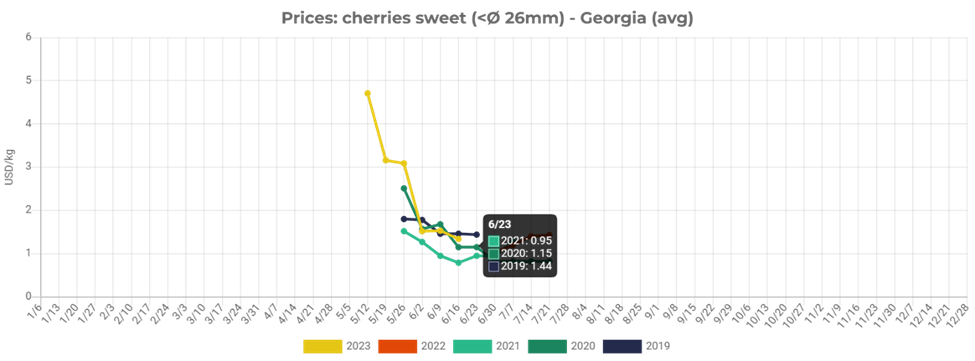

In Georgia, the wholesale market currently sells mainly red-colored cherry varieties at prices ranging from 3 to 8 GEL/kg ($1.15-3.07), depending on the caliber. Now is just the middle of the season for the sale of these fruits. At the same time, harvesting has not yet begun in the Shida Kartli region – here the harvesting will begin in 10 days, and prices at this time may still decrease.

In Georgia, sweet cherry production is concentrated in small farms – mostly farmers have areas of less than 5 hectares.

As you can see, the prices for cherries in Georgia are now relatively high, which confirms the relatively low yields of these fruits in the countries of Central Asia, which affects the prices of the entire region.

As you can see, the prices for cherries in Georgia are now relatively high, which confirms the relatively low yields of these fruits in the countries of Central Asia, which affects the prices of the entire region.

Please see below a few photos from the Tbilisi wholesale market of different size and varieties of cherries.

Moldova

The cherry harvest in Moldova this year is assessed by experts as average or even below average. If it rains in the near future, then there will be a problem with cracking of fruits, and part of the crop will remain on the trees. Estimates of the commercia cherry production for Moldova in 2023 are at 8-9 thousand tons of marketable fruits maximum.

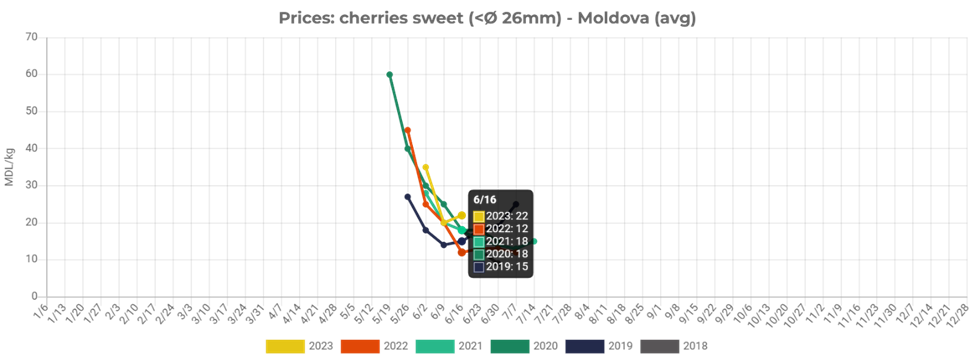

At the moment, in Moldova, cherries up to 26 mm in caliber in the wholesale markets cost 22-25 MDL per kg, which is equivalent to $1.23-1.40 US dollars per kg. Larger 26+ caliber cherries are sold for 27-30 lei per kg ($1.51-1.68).

Despite the fact that prices for sweet cherries in Moldova seem relatively low – because they are lower than in Uzbekistan, Tajikistan or Georgia, they are record high for this period of the year for the country.

Currently there are cherries of such varieties as Roket, Bigarreou, Valery Chkalov, Stella, Fresco and others on the market. These varieties are exported mainly to the traditional markets of Belarus and Russia. In a week, Techlovan cherries will ripen, then, after about 2 more weeks, Kordia and Regina cherries will be ready for picking. These varieties will already be exported, according to market participants, mainly to the EU countries.

The biggest problem of cherry farmers in Moldova, according to representatives of the Federation of Agricultural Producers of the Republic of Moldova FARM, is the shortage of labor. Farmers fear that the aggravation of labor shortage in 2023 will not allow them to fully harvest the entire cherry crop and fill trucks for export.

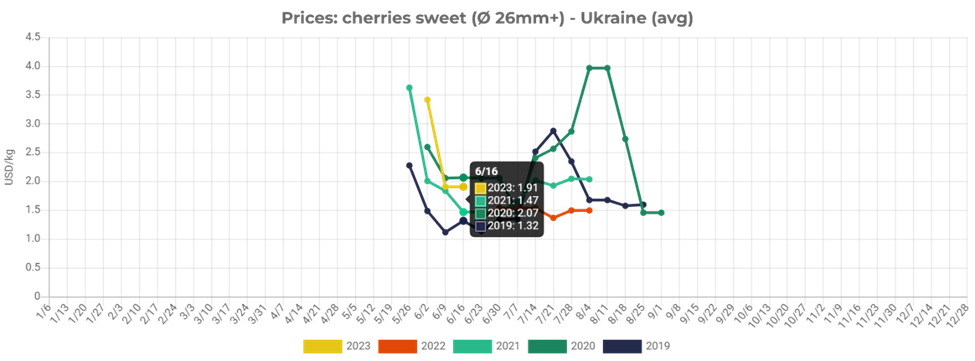

Ukraine

In Ukraine, the cherry season starts the latest. This year it started at about the same time as last year. That the main cherry growing region of Ukraine, which is the Melitopol, is still occupied by Russian invaders, and there are very few people left there. Nobody should not expect significant volumes of cherry harvesting there, although the invaders boasted earlier of big plans to export it to Russia.

However, these volumes, of course, will not affect the Ukrainian market in any way, which last year was forced to import cherries in significant volumes.

At the end of May, the Ukrainian market received small volumes of sweet cherries from Spain at wholesale prices above UAH 750 per kg (over $20 USD per kg). However, due to the absence of more than 7 million main consumers of cherries, i.e. women and children who became refugees due to the Russian invasion, there was almost no demand for these products. A week later, the price of imported fruit has already dropped by almost half, and importers, most likely, have suffered losses.

The first Ukrainian sweet cherry of early varieties has been traded on the market since the first days of June 2023, and wholesale prices for these fruits were in the range of 60-80 UAH/kg ($1.6-2.2). The quality of the first sweet cherry was assessed as mediocre.

As of June 13, 2023 wholesale prices for local cherries are in the range of 60-90 UAH/kg ($1.6-2.5). In the southern region, the upper price limit is lower – it is 70 UAH/kg ($1.9). In the western regions of Ukraine, prices do not fall below UAH 80/kg ($2.2).

Cold weather and rains, which are now observed throughout Ukraine, will negatively affect the quality of medium and late cherries. Now everyone is expecting a slight increase in prices due to the beginning of the season of Valery Chkalov sweet cherries, which have a larger caliber and a more attractive coloring. However, the quality prospects remain questionable.

Therefore, a paradoxical situation may arise when there will be two price ranges with different trends on the market – prices for low-quality sweet cherries will decrease, while prices for high-quality cherries will, on the contrary, grow.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.