According to EastFruit analysts, global trade in hazelnuts is falling by 8%, or an average of $144 million per year. In addition, there is a decrease in the average world price for the hazelnut kernel by 25% – from $8.708/ton, FOB, on average in 2013-2015 to $6.574/ton an average in 2017-2019, FOB. At the same time, revenues from the exports of hazelnuts decreased by 12% in 2017-2019 compared to 2013-2015.

What is the reason for this situation in the world market and what does this mean for producers in our region? Analysts of the EastFruit Georgian office tried to figure it out. Indeed, for Georgia, hazelnuts remain the main source of export revenues in the agricultural sector, after Georgian wine.

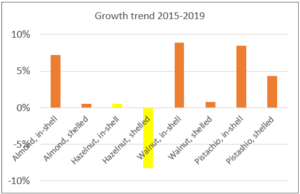

Graph 1: Average annual changes in world trade volumes for almonds, hazelnuts, walnuts and pistachios over 5 years

Source of data: Trademap

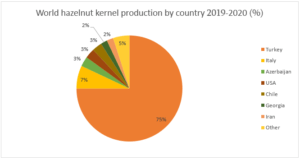

The production and trade of hazelnuts is highly concentrated. The largest producer and exporter of hazelnuts in the world is Turkey. Turkey accounts for over 70% of world production and about 75% of world exports. The remaining 25% are with Italy, Azerbaijan, USA, Chile, Georgia and Iran.

Graph 2: Structure of hazelnut kernel production by country

Source: INC

In 2020, compared to 2019, the exports of hazelnuts from Turkey decreased by 19%, which reduced the revenue from the export of hazelnuts of this country by 11%. As EastFruit already reported, during the export season 2020/21 (September 1 – December 31, 2020), Turkey exported 106.8 thousand tons of hazelnuts worth $ 732.8 million. Considering that exports for the same period of the 2019/20 season amounted to 168.0 thousand tons, and about $ 1.1 billion, export volumes decreased by 36.4%, and the value by 32.7%.

Analysts associate the decrease in export volumes from Turkey with unfavorable weather conditions – a drought in 2019-2020 on the Black Sea coast of Turkey, where most of the hazelnuts are produced, and bad weather in the second half of August 2020, when a large flood occurred in the main producing region – Ordu province. Another problem producers in Turkey face is the brown marmorated stink bug (Halyomorpha halys), an insect that has already caused significant damage to the walnut industry in neighboring Georgia.

The main consumer of hazelnuts in the world is the EU confectionery industry, which accounts for 80% of all hazelnut purchases. About a third of Turkish hazelnuts are purchased by the Italian Ferrero Group, which uses them mainly for the production of Nutella nut-chocolate paste, as well as in other confectionery products.

Over the past few years, Ferrero has appeared periodically in the press in the context of the traceability of the supply chain of the ingredients used – hazelnuts, palm oil, cocoa. This prompted the producer to launch a Made in Italy campaign aimed at increasing Italy’s hazelnut plantings by 30% from 2019 to 2025. Ferrero commits to purchase 75% of the annual production from the farmers who participate in the project. The base purchase price takes into account standard production costs plus a margin that will be weighted at 30% by the Turkish price index. The initiative is supported by a specially developed financial instrument of Crédit Agricole, which provides a 5-year grace period for the repayment of the loan principal.

Another 20% of Turkish hazelnuts are purchased by Olam Group, one of the largest processors and suppliers to the B2B sector (the presentation on the hazelnut market by the representative of Olam at the Georgia Nuts Conference can be viewed here).

In order to reduce the risks, these international companies, as well as some European chocolate producers, have been trying to diversify the sources of hazelnuts in the past 10 years, which was the impetus for the rapid development of hazelnut production in Georgia, Azerbaijan, Serbia, Argentina, Chile, Australia, South Africa, Ukraine, Kazakhstan and Uzbekistan.

Graph 3: Dynamics of changes in the harvested area of hazelnuts in selected countries from 2010 to 2019

Source: FAOstat

The advantage of new plantations over old ones is the use of the newest intensive technologies for growing hazelnuts on the basis of many years’ vast experience. Also, new plantations allow selecting the best varieties. Accordingly, in new hazelnut orchards, as a rule, the yield and quality of the walnut kernel are higher, which means that there is an opportunity to receive more favorable prices for products.

For instance, Chile, that practically did not export hazelnuts until 2015, has already surpassed Georgia in terms of hazelnut exports this season. Even in 2020, Chile exported 27% more hazelnuts than Georgia. Azerbaijan is also one of the three world leaders in the export of hazelnuts in quantitative terms, after Turkey and Italy.

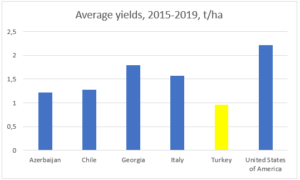

Chart 4: Average Hazelnut Yields in Leading Producing Countries 2015-2019

Source: FAOstat

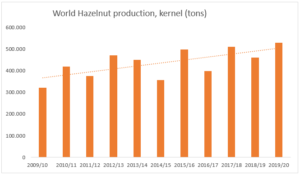

Despite the negative trends in world trade, we cannot say that the world is rejecting hazelnuts, or that consumers have stopped loving hazelnuts. According to the INC (International Nuts Council), production of hazelnut kernels in the 2019/20 season peaked in the last ten years at 528,000 tonnes (kernel). It is 14% or 68 thousand tons more than in the 2018/19 season.

However, the truth is that hazelnut production is becoming more local and production concentration is declining. Considering that the hazelnut orchards laid down several years ago are gradually beginning to bear fruit in different parts of the world, consumers need not worry about the shortage of Nutella for at least the next 10 years.

Graph 5: Dynamics of world production of hazelnut kernels from 2009 to 2019, tons

Source: INC

Investors should consider the negative indicators of trade growth and critically approach the calculations in business plans for the development of nut projects, given the growth of local production. Indeed, with an increase in production and a decrease in the volume of world trade, prices, as a rule, are under serious pressure.

However, one must also remember that new difficulties are new opportunities. In the opinion of EastFruit, these opportunities are in increasing the efficiency and quality of production, as well as in creating added value through nut processing and local production of confectionery and other nut products.

It is also worth taking a closer look at new sales markets, for example, China and the United Arab Emirates, which are actively increasing imports of hazelnut kernels, although the volumes of these imports are still insignificant.

Graph 6: Change in import volumes of hazelnut kernels from 2009 to 2019 by countries in tons, %

Data source: Trademap

As you can see in the graph, Mexico, the Netherlands, Tunisia, Poland, Italy, Romania, Brazil and Russia were among the countries that have been actively increasing their imports of hazelnuts in the last decade. Accordingly, for those who are now investing in the cultivation of hazelnuts, it is important to pay attention, first of all, to the hazelnut markets of these countries, along with China, the United Arab Emirates and the existing large importers of these nuts.

It should also be noted that an increase in the supply of other types of nuts, primarily from countries with tropical climates, is observed. Today, cashews are already the leader in world trade among all types of nuts, the production and export rates of which are also growing at a higher pace than those of other nuts. Niche types of nuts such as kola nut, macadamia nut and betel nut are also on their way. This, in turn, further increases the pressure on the prices of traditional nuts.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.

1 comment