According to EastFruit analysts, the numerous statements about record low prices for blueberries in 2021 in Ukraine are not entirely true.

Perhaps the reason for such statements made by market players was the comparison of actual prices with the prices in 2020, when they were abnormally high due to the sharp decline in production volumes. However, if we compare the wholesale prices for high-quality blueberries with the 2019 season, it becomes obvious that in 2019 the situation was worse for growers.

However, there are a few important points to make before diving into the facts of the pricing realities of the 2021 blueberry season. First of all, EastFruit takes into account the prices for the finished product, i.e. for blueberries that meet the requirements of the fresh berry market in terms of size, freshness, quality, packaging and batch volume and we do not cosnider low quality produce. Secondly, we focus on the prices of top qiality blueberries according to Ukrainian standards which are simply standard quality bluberries in the EU. Blueberries are an export-oriented product and the global blueberry trade is growing steadily, which makes us ignore pricing of the produce that does not meet international quality requirements. And, of course, we took into account that the berry season shifted by two weeks in 2021.

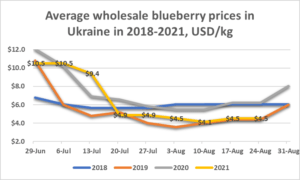

As you can see in the chart below, in 2019, from the second half of July to the second half of August 2021, wholesale prices for premium blueberries in Ukraine were consistently 30-50 UAH/kg lower than in 2021. During this period, the average price for blueberries in 2021 was 122 UAH/kg ($4.6 per kg), and in 2019 – 107 UAH / kg ($ 4.3 per kg). Thus, blueberries were sold in 2021 on average 14% more expensive in local currency and 7% more expensive in US dollars.

Also, for the season as a whole, according to our estimates, the average price in 2019 amounted to UAH 133/kg (about $5.3), and in 2021 the price will be closer to UAH 120/kg (also about $5.3 per kg at the current exchange rate). Thus, in local currency, Ukrainian blueberry growers will receive on average 5% more for their berries, and in terms of US dollars the price will be comparable.

However, this does not mean at all that the circumstances would be positive for all of the growers, because in Ukraine many of them have insufficient volumes to sell to supermarket chains or to export, but also too large volumes to sell directly to consumers with home delivery or even on the wholesale markets. Also, many growers do not have capacity for pre-cooling, soring and grading and end up getting to pay intermediaries for this service.

In 2019 Ukraine exported record volumes of blueberries, but in 2020, the volume of blueberry exports from Ukraine dropped sharply. In 2021, blueberry exports rose sharply again, although international prices fell. In neighboring Poland, for example, growers were selling blueberries in 2021 even cheaper than Ukrainian growers. At the same time, the price of blueberries in Poland has also slightly decreased in 2021 compared to 2019.

Why haven’t prices for high-quality blueberries in Ukraine dropped below 2019? This is partly due to the better provision of pre-cooling and storage facilities for Ukrainian growers, which made it possible to place blueberry batches for temporary storage during periods of price collapse. The same reason made it possible to accumulate and enlarge batches, which created certain advantages in the exports of berries.

Another reason is the start of the blueberry processing. For the first time in Ukraine, blueberries were sold to freezers. Of course, only the cheapest categories of berries were used for freezing. There were reports about the sale of blueberries for freezing at prices of about 60 UAH / kg ($ 2.25 per kg). If these cheap berries got to the fresh market, the collapse would not have been avoided even in the segment of high quality berries. By the way, in 2020 Ukraine received an approval to export frozen blueberries to China but back then prices were too high on the fresh market and nothing was exported. Therefore, it is possible that in 2021 we will see the first deliveries of frozen blueberries to China.

Export contacts accumulated by Ukrainian growers during trade missions organized by FAO and EBRD projects in 2018-2019 to the Middle East, the European Union and Southeast Asia also played an important role in supporting the prices domestically. .

Obviously, high-quality blueberries are in demand even during the seasons when the supply of berries increases dramatically. At the same time, it is very important for business success that the grower has the ability to continuously ship batches of high-quality blueberries of the required volume and the flexibility in responding to the needs of key buyers.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.