What is pooling, and how and why did it appear?

The dynamic development of retail chains and distribution in developed countries has contributed to the constant introduction of new logistics solutions, and innovations, as well as reducing costs along the supply chain. The highest competition in the industry forced supermarket chains and wholesalers to constantly look for solutions that would allow them to gain advantages.

In addition, the leading countries have gradually tightened environmental standards and sought to reduce the amount of waste that cannot be recycled. At the same time, the trend of environmental and economic sustainability of business has gained momentum over the years.

On this wave, pooling appeared – using reusable foldable plastic boxes (collapsible crates or collapsible boxes) for packaging, storage, and distribution of goods. This system solves many problems production and trade, primarily food, faces.

Although the pooling system has been operating in the leading countries for more than 30 years, retail chains in Uzbekistan and other countries of Central Asia, as well as in Georgia and Moldova, have not yet introduced it.

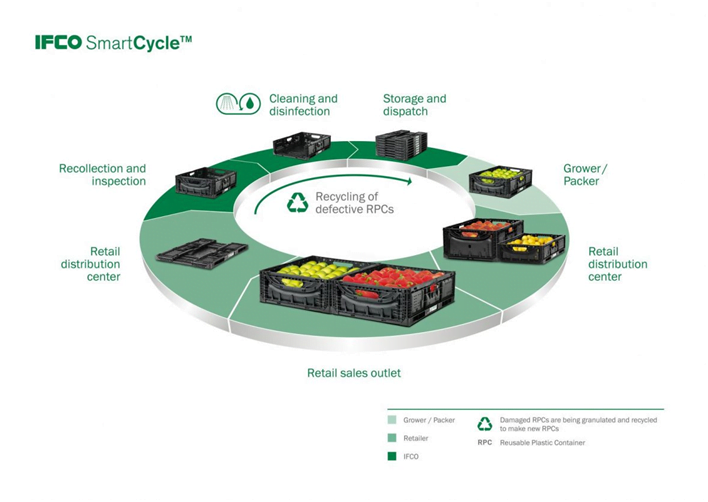

Pooling is especially important for the supply and distribution of perishable products such as fruit, vegetables, meat, and milk. The image below shows an example of a pooling cycle of the IFCO company.

What are the advantages of reusable plastic containers?

- Durability – a box can withstand up to 120 or more cycles and can be used for 7-10 years!

- Sustainability – each crate saves the equivalent of 120 cardboard or wooden crates – thus saving many trees and drastically reducing the burden on the waste management system, which also releases large amounts of greenhouse gases.

- Profitability – the cost of reusable packaging is on average two or more times lower than the cost of disposable packaging, which allows: a) to make the product more affordable for consumers; b) increase the price of products for farmers, increasing the sustainability of production. The same goals are achieved by reducing the cost of transporting products.

- Food safety – most products are packed by producers and put on the sales floor in the same box, which significantly reduces the number of contacts and risks to consumer health. In addition, containers made of high-quality food-grade plastic are less susceptible to contamination compared to wooden or plastic ones.

- Reducing product losses – box strength, immunity to moisture, design to ensure maximum safety of products, faster delivery and fewer reloads and repackages with less mechanical damage, can significantly reduce product losses from the producer to the final consumer, making products more accessible to a consumer, and production more profitable for a farmer.

- Quality and freshness of products– thanks to the advantages in the previous point, products arrive to the consumer fresher and of higher quality, which increases the demand for them.

- Reducing product losses at the stage of consumption – higher quality and freshness of products, especially vegetables, and fruits, allow them to stay fresh longer for the consumer, which reduces losses at this stage as well. This also has a positive effect on the environment, reducing the burden on the waste disposal system.

- Increase in sales – reusable foldable boxes serve as an attractive and stylish display for products, which increases sales.

- Reducing costs of supermarkets – supermarket chains can reduce on-store labor costs by an average of 10% by reducing time spent on display and disposal of containers.

- The reduction in transport costs for all participants is achieved since folded boxes are returned from supermarkets and delivered to producers, taking up 5-6 times less space than assembled containers. Thus, 5-6 times fewer rides are needed to transport these containers than for the transportation of alternative options. This helps reduce emissions of harmful substances into the atmosphere and costs.

- Reducing real estate costs – this is important for both producers and wholesalers. However, it is especially important for supermarket chains, which are mainly located in densely populated areas of cities with expensive real estate. Pooling containers, after use, take up 5-6 times less space than conventional ones. It makes it possible to reduce the area required for their storage and real estate costs.

- International trade –in countries with free import and export of reusable pooling containers (for example, in the EU countries), this allows you to dramatically increase the volume of international trade by increasing the efficiency of logistics and reducing its costs.

How did pooling evolve in the EU or what do pallets have to do with it?

How did pooling evolve in the EU or what do pallets have to do with it?

Pooling is a prime example of a new global trend – sharing economy, when the business model is based on the collective use of goods and services, exchange, and rent instead of owning them.

Modern business models of the pooling of reusable containers started evolving in the EU countries in the early 90s, but the concept of pooling arose much earlier in the wooden pallet market. The pioneer was CHEP (Commonwealth Handling Equipment Pool), which arose from an organization established by the Australian government to manage Allied military supplies during World War II. When the war ended, the US Army left behind millions of blue pallets at US military bases in Australia, which had to be used somehow. The Australian government set up CHEP, a state-owned enterprise, to manage a huge database of pallets. In 1958, the Australian private company Brambles purchased CHEP and created the world’s largest pallet pool.

Fruit and vegetable auctions in the Netherlands, Belgium, and Germany played an important role in creating the pooling business model. They were among the first to use reusable plastic packaging in the EU as a single standard package for all auction participants. In 1992, the representatives of these auctions created the company EURO POOL SYSTEM, which is currently one of the global leaders in the pooling of reversible foldable containers.

Effective accounting and minimization of losses of reusable containers have always been difficult tasks for most pooling companies, especially at the beginning of the formation of the pooling market. However, pooling companies solved it initially by applying a security deposit, which compensated for the cost of lost or damaged containers. On the one hand, this business model minimized the risks of pooling companies as much as possible, but on the other, it hindered the development of the service, because companies had to constantly freeze huge working capital for collateral deposits.

Therefore, the next important step was the integration of the pooling system into the supply chains of international retail, thanks to which pooling companies gradually abandoned collateral deposits, preferring long-term contracts with retail chains, where conditions to protect the property rights of pooling companies were determined.

Since the share of EU retail chains in food retail reaches 70 to 90%, it is retail chains that have formed and continue to form a stable constant demand for pooling services, as well as stimulate efficiency improvements and the introduction of logistics innovations.

Another important factor was the efficient EU legislation on the protection of property rights, and the maximum simplification of customs legislation on the movement of reusable containers both within the European Union and outside it.

The expansion of the EU in Central and Eastern Europe also favorably affected the pooling business, when branches of the largest pooling companies were opened in most of the new member states from 2005 to 2010, except for Lithuania, Latvia, Estonia, Romania, and Bulgaria.

Branches were opened in Romania and Bulgaria in 2017. In Estonia, a local pooling operator appeared in 2010, which competed with the largest pooling companies in the regional market and entered the Bulgarian market. Its main specialization was the provision of pooling services for suppliers of dairy and meat products, and the share of operations with fresh fruits and vegetables did not exceed 5%.

Who are the market leaders in pooling services for reusable packaging in the EU?

The rapid development of the pooling services market has created opportunities for the evolution of various types of pooling companies. Most of the EU pooling market is now controlled by IFCO, EURO POOL SYSTEM, TOSCA, and Container Centralen. These international companies provide pooling services in markets of more than 50 countries around the world. There are also strong pooling companies that concentrate on the local markets of their countries, for example, in the UK, Spain, Italy, Germany, Sweden, Finland, and the Baltic countries. Such companies not only successfully competed with global players but also continued to develop actively.

The international expansion of pooling is the most important factor of competitiveness in the global market of vegetables and fruits

Despite the ever-growing and huge EU market, the international pooling companies were not going to stay within their size. The fruit and vegetable business participants quickly became aware of the advantages of international trade using reusable pooling containers, which significantly increased the competitiveness for suppliers, expanded opportunities for the development of fruit and vegetable production in the country, and gave importers and chains important advantages over competitors.

Naturally, when expanding to the global market, pooling operators focused on the volume of exports to the EU and imports from the EU to increase the maximum efficiency of using the existing container pool.

Therefore, in 1993, the largest international pooling operator IFCO set up a company in Argentina, in 1994 in Japan, in 1999 in South Africa, in 2000 in Turkey and the USA, in 2006 in Brazil, in 2011 in Serbia, in 2015 in China and Chile, in 2016 in Canada and Colombia. It expanded through the opening of new companies and investments in the infrastructure, and through mergers and acquisitions of regional pooling companies, for example in Chile, Colombia, and Japan. While international pooling companies initially focused on trade flows associated with the EU market, after large-scale investments in the USA, South America, and Asia, dependence on the European market began to decline rapidly.

Pallets are the most important part of the pooling system

When developing and responding to demand, most international pooling companies tried to cover the needs of their customers for reusable shipping containers, which include plastic containers, and wooden and plastic pallets. Therefore, pooling companies actively expanded their pallet stock, providing retail chains with a full service, and CHEP, the world’s largest pooling operator of wooden pallets, began investing in its own pool of reusable pooling containers. The international pooling operator EURO POOL SYSTEM created the LPR company in 1992, which rents red wooden and plastic pallets in the EU market. The company’s turnover in 2022 amounted to about 300 million EUR.

Pooling pallet example

International mergers and acquisitions of pooling companies attract even portfolio investors

The competition has led to significant transformations in the market because CHEP sold its pool of reusable containers in the United States to IFCO in 2005, but CHEP acquired IFCO for $1.25 billion in 2010, dividing the pallet pooling and plastic container business between the two companies, and sold IFCO to international investment funds for $2.5 billion in 2019 while leaving plastic container pooling operators in Australia, New Zealand, and South Africa.

The main driver for the development of pooling companies has been the fruit and vegetable industry, as single-use transport packaging for fresh fruit and vegetable products is much more expensive than transport packages from other industries. Also, there are many write-offs in the supply chain of fresh fruits and vegetables, when disposable containers for transportation and additional containers for display on the trading floor are used.

Will pooling kill the banana box market, destroying the main flow of packaging for the countries of Central Asia, the Caucasus, and Eastern Europe?

A prime example of the globalization of the fruit and vegetable trade through pooling companies is the use of reusable plastic packaging by banana exporters in Ecuador. Their main motivation is that the cost of renting a pooling container is twice cheaper than buying a disposable banana box, which now costs more than $2.

Even though reusable packaging is transported from Ecuador to the EU and back for more than 50 days, it is still profitable. However, to launch new directions, pooling companies need a scale – as a rule, the minimum guaranteed market volume should be at least 1 million boxes per turnover, which is about 19 000 tonnes. And there should be at least four turnovers between two market participants per year. Only then the international pooling operator begins to study a new direction, assessing the risks, the necessary investments, and the potential profitability.

Of course, it is equally important that countries buying bananas have all the necessary conditions for launching a pooling system. Therefore, it cannot be ruled out that it is banana imports that are now the main source of de facto reusable cardboard packaging (banana boxes) for Uzbekistan, Georgia, Tajikistan, and Moldova. They can not only attract international pooling operators to these countries but also sharply increase the cost of logistics for those market participants who do not participate in pooling due to the growth in the cost of banana boxes. As a result, even small market participants will be forced to join the pooling system, because it will be more profitable than buying expensive disposable, unreliable, and low-quality containers.

What is the size of the pooling container market in the EU, how fast is it growing and what are the drivers for it? What are ESG principles?

By the end of 2022, the largest operators of pooling systems in the European Union were managing a stock of more than 1 billion reusable foldable plastic boxes, making more than 6 billion container turnovers annually. The turnover of these companies reaches 2 billion EUR.

According to various estimates, the growth of the EU pooling container market in the coming years will reach 4-6% per year.

One of the key advantages of pooling, which has become the most important driver of market development in recent years, is its environmental friendliness compared to other types of single-use transport packaging. Considering that most international pooling companies attracted significant investments for their expansion on good terms, which could only be attracted by observing the principles of ESG (Environmental, social, and corporate governance).

ESG principles are also important for investment fund portfolios. Therefore, pooling companies became the pioneers of the ESG investment market, which was formed after 2011. Market leaders compile ESG reports annually, where they note how much CO2 emissions, water, and electricity were saved during the year using a sustainable business development model, namely, pooling. Naturally, for companies from Uzbekistan, Tajikistan, Georgia, Moldova, and other countries of the region, the use of the pooling system will simplify access to such investments, and this should not be underestimated either!

The development of pooling has allowed manufacturers of plastic containers to get a new market and maximize production capacity. In addition, investments in the production of washing equipment received a new impetus. Leasing companies were also involved.

Innovations and IT as critical factors in the development of pooling

Continuous innovation of pooling companies faster than retail, allows them to be strategic partners for retail chains and manufacturing enterprises. For example, as soon as retail chains started investing in distribution center automation, pooling companies began to invest in IT solutions and new designs of reusable plastic boxes, which significantly increase the efficiency of inventory and distribution of products.

The growing robotization of manufacturing enterprises, and distribution centers of retail chains in the EU and the USA should also be noted. This was partly due to the acute shortage of people willing to do such a monotonous job and very high labor costs, influencing the cost of production. Increasing demands for food safety have also been an additional impetus, so it was necessary to eliminate the risk of the spread of viruses and other human-borne diseases.

Pooling companies increase their investments in the robotization of their service centers annually to increase the productivity of washing and packaging lines and the competitiveness of the services provided.

For example, the use of RFID (radio frequency identification) is a method for the automatic identification of objects when data stored in RFID tags placed on each box are read with radio signals. RFID technology is the basis for the large-scale application of the IoT by pooling companies in the future, which will allow to monitor the stocks and movement of reusable containers, and to collect important data about the products in them, increasing traceability, quality control and compliance with the FIFO principle (First In – First Out – a system of cargo turnover, when the cargo that first came to the warehouse is the first to be shipped from it).

An example of an IT solution that allows RFID to control assets

Another example is devising special packaging for the E-Grocery industry that responds to the logistics needs of retail chains in the formation and delivery of products to the final consumer. For this segment, slots are made on the sides of reusable containers, which allow fixing plastic bags, increasing the efficiency of preparing and issuing orders.

An example of a pooling box created for the needs of E- Grocery

The role of pooling in reducing the climate change

The facts about pooling and the dynamic history of its development convincingly prove that its prospects are huge. Particularly relevant is the positive impact of the effective use of reusable foldable containers on climate change. We need to focus on each word, as throwing out any of them (efficiency, turnover, reusability, or folding) will drastically reduce the positive effect of pooling.

Pooling allows to reduce the number of truck rides, and product losses at all stages of product distribution, dramatically reduce the amount of waste, including non-recyclable waste, reduce the area of warehouses and retailers, etc. Thus, pooling is a prime example of a new type of circular economy needed to reduce human impact on the environment.

It is expected that the share of recycled plastic containers will reach 60% in the EU countries soon. In Ukraine, the pooling system has been operating for more than ten years and its share is also actively growing. We hope that pooling containers will also be actively used in Georgia, Moldova, Uzbekistan, and Tajikistan in the coming years – in those countries where the EastFruit project operates. However, we will be happy to share our experience with colleagues from other countries interested in the development of pooling in their countries and regions.

Andriy Yarmak, Economist at the FAO Investment Center

Fedir Rybalko, FAO International Consultant

We used photos and figures from the following sources in this material:

- IFCO ESG Report 2022 https://www.ifco.com/about-ifco/sustainability/esg-report-2022/

2. EURO POOL SYSTEM ESG Report 2021 https://www.europoolsystem.com/sustainability-report-2021/foreword

3. CHEP Zero Waste World Program https://www.chep.com/sustainability

4. TOSCA ESG Report 2022 https://www.toscaltd.com/sustainability/

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.