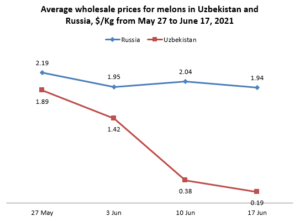

EastFruit experts report the beginning of the season of peak exports of melons from Uzbekistan. This is evidenced by two factors – a 10-fold decrease in wholesale prices on the domestic market from the end of May to June 17 and a noticeable activation in the second half of last week of exports of melons to foreign markets. Over the past 4-5 days, the number of requests for trucks for transporting melons to export markets has many times exceeded those of the first half of June.

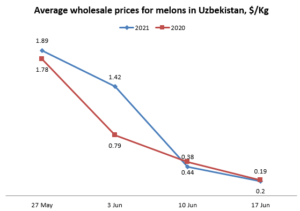

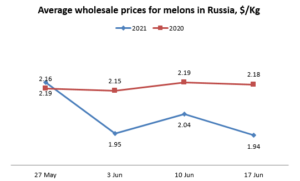

In the current season, the dynamics of prices for melon in Uzbekistan in the first half of June repeats the last year’s picture. In addition, the dynamics of melons prices on the Russian market is also almost the same as last year, although prices there are much lower. Since almost all Uzbek melon is exported to Russia directly and through Kazakhstan and Kyrgyzstan, the difference in prices between the markets of the Russian Federation and Uzbekistan determines the start of mass export of melons.

The decrease in wholesale prices for melons in Uzbekistan by almost 10 times over the past three weeks and their stable prices on the Russian market over this period sharply increased the price gap in Uzbekistan and Russia. As of June 17, the average wholesale prices for melons were 10 times lower in Uzbekistan than in Russia. In addition, prices for melon in Uzbekistan have decreased so that they are already approaching to an acceptable level for Russian consumers, taking into account logistics and intermediary margins. In other words, when melons are exported from Uzbekistan at these prices, it will be available to a wider range of consumers in Russia. Most importantly, with such a price gap, the import of melons from Uzbekistan is becoming a profitable business for Russian fruit importers.

At the end of May, the difference in melon prices on the markets of the Russian Federation and Uzbekistan was only 30 US cents, which barely covered the delivery costs. Therefore, trade was inactive and not very profitable. Wholesale prices for melons in Russia are now already $ 1.75 per kg higher than in Uzbekistan. This means that the sale of melons with such a “gap” becomes very profitable and covers not only transport costs, but also high-quality sorting, packaging, processing and the margin of many intermediaries.

According to East Fruit analysts, wholesale prices for melon in Uzbekistan will further decline at a slower pace. The melon harvest season in the country is entering an active phase, and with an increase of supply on the market the demand will also grow both in the domestic and foreign markets, which will stabilize the prices for it.

Uzbekistan is one of the ten largest exporters of fresh melon in the world. Uzbekistan used to export almost all melons to Russia, as well as to Kazakhstan and Kyrgyzstan, but in 2020 the markets of Uzbek melon exports have significantly expanded. The EU appreciated melons from Uzbekistan, in particular, Germany, where a record amount of Uzbek melons was exported – 861 tons per season! In addition to Germany, a number of other EU countries have started importing Uzbek melons. Ukraine, Belarus and Moldova also increased the import of these sweet fruits.

Therefore, there is hope that in 2021 the export of Uzbek melon will increase and will partially compensate for the huge losses that the fruit and vegetable business of Uzbekistan suffered from a decrease in the yield and export of stone fruits, especially apricots and cherries.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.