According to the Customs Service of the Republic of Moldova, in January-February 2021, about 28 thousand tons of apples were exported from the country. In the same period last year, the exported volume of Moldovan apples was significantly higher – almost 54 thousand tons. In the first half of March this year, according to the local organizations of agricultural producers and exporters, the export of apples to the main markets (Russia, Belarus, Kazakhstan) has not yet intensified. But the prices started to rise – on average by 0.5-1.5 MDL / kg.

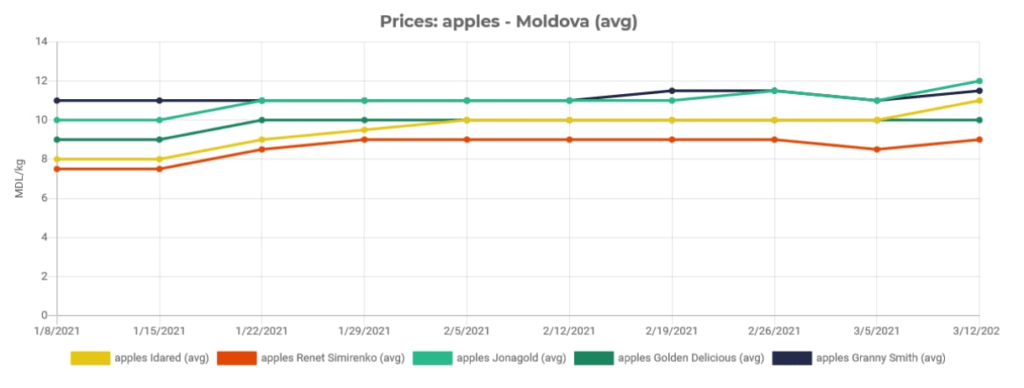

Based on the monitoring of EastFruit , by the beginning of this week, wholesale prices for apples of the Renet Simirenko and Idared varieties ranged from 8.5-11.5 MDL / kg ($ 0.48-0.65 / kg), “Golden Delicious”, “Jonagold” and “Granny Smith”- 10.0-12.5 MDL ($ 0.57-0.71 / kg).

At first glance, one gets the impression that in mid-March there was a moment of steady growth in demand and prices for apples, which Moldovan producers and traders had been expecting from mid-January. However, the managers of the exporting companies speak more of a “spring stillness”: if last year in the first half of March they delivered 10-12 truckloads to the Russian Federation every day, now the delivered volume is around two, three truckloads. Compared to the previous month, a slight increase in demand is noted only for apples of relatively high quality, and not strictly depending on the variety. Taking this into account, it is difficult to expect that the export of apples in March this year will be close to the exported levels achieved in March in the previous two years – 30-40 thousand tons.

At first glance, one gets the impression that in mid-March there was a moment of steady growth in demand and prices for apples, which Moldovan producers and traders had been expecting from mid-January. However, the managers of the exporting companies speak more of a “spring stillness”: if last year in the first half of March they delivered 10-12 truckloads to the Russian Federation every day, now the delivered volume is around two, three truckloads. Compared to the previous month, a slight increase in demand is noted only for apples of relatively high quality, and not strictly depending on the variety. Taking this into account, it is difficult to expect that the export of apples in March this year will be close to the exported levels achieved in March in the previous two years – 30-40 thousand tons.

How the situation will develop next month is not clear. Optimists believe that in April the Russian stocks of apples will finally run out. Instead of importing Polish and Ukrainian apples through risky channels, Russian traders will consider it a safer option to legally import Moldovan apples of comparable (or, in extreme cases, marginally inferior) quality at a slightly higher price. Something similar happened last year, when in April supplies of apples from Moldova to Russia increased by 10 thousand tons compared to the previous month – to almost 39 thousand tons. Although in some of the past 5 years, March was the month with the highest export volumes for the Moldovan Apples.

Pessimists believe that the increase in exports of Moldovan apples in April-May compared to February-March is not very realistic, given the generally low quality of the 2020 harvest. In the lower quality segment on the Russian market, apples from Moldova have alternatives, for example, apples from Iran.

Moreover, experts of agricultural producers’ associations believe that around half of the apples marketable stock available today – about 80-100 thousand tons – belongs to the third quality category and is more suitable for processing than for fresh export.

Representatives of the “Speranța-Con” Association of Canned Fruit and Vegetable Producers claim that three or four factories are technically and logistically capable of receiving up to 3-5 thousand tons of apples per day for processing over the spring. Two years ago, there was already a precedent – in March-May, the operators of the canning industry purchased about 20 thousand tons of apples. However, this was a consequence of the most fruitful season of 2018, when the country produced 665 thousand tons of apples.

At the same time, the directors of the largest canning companies in Moldova consider it unlikely that this year, despite the significant stored volumes, more than 2-3 thousand tons of apples will be supplied for industrial processing in the spring. In winter, when the price for unclarified apple concentrate was above 700 euros / ton, the price offered for processing-grade apples in Moldova was about 2 MDL / kg (0.2 euros / kg). In March, according to Moldovan concentrate traders, the price of concentrate in the European Union decreased, while there was practically no demand for it. Consequently, there are no grounds for raising purchase prices for apples.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.