According to the official statistics of the Ministry of Finance of Georgia, the export of Georgian hazelnuts in November 2021 amounted to about 2,800 tonnes of kernels, which is a record volume since 2016. Georgian hazelnuts, previously rejected at EU borders, are sorted, repackaged and sent back to the EU, EastFruit reports. Thus, the export statistics may include some hazelnuts twice and, as we discussed earlier, there were many rejections this season, which began in September 2021.

Unusually high exports of inshell hazelnuts continued. In November 2021, Georgia exported 1,200 tonnes of inshell hazelnuts. This is about 3-4 times more than the average in November over the past 7 years. The driving factor remained unchanged – it is the demand from Italy due to the lack of its own supply caused by a poor harvest. Notably, 25% of total exports in November went to China, which could be a lucrative destination for Georgian hazelnuts. Italy and China paid a good price, $3.10/kg (FOB), which is $0.60 more than the average export price for all other destinations. The prices are based on previously signed contracts, and it is not clear if they will remain in the future.ù

Data source: Ministry of Finance of Georgia

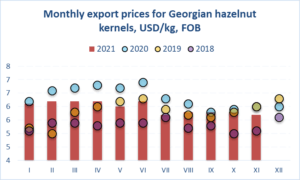

Shelled hazelnuts still dominate Georgia’s hazelnut exports. Exports in November amounted to 2,160 tonnes, the highest since 2016. Exporters received $12.4 million, which is 3.6 times more than the proceeds from the exports of inshell hazelnuts. The average export price fell to $5.70/kg from $5.80 in October. This average price is $0.30 lower than last November. It is also the lowest price in at least 8 years, excluding the years when the marble bug infestation peaked.

Read also: Georgian hazelnut prices plummet to four-year low

Some key stakeholders in Georgia are concerned that they cannot compete with prices in Turkey, where depreciation of the national currency makes exports cheaper. However, Turkey is also experiencing a very high level of inflation, and the entire global market is in a wait-and-see position, monitoring the difficult situation there.

The growing number of COVID-19 cases in Europe, the main buyer of hazelnuts, is also playing a big role now. New restrictions, if introduced, are likely to mean a drop in demand.

All in all, negotiating new contracts is challenging for both Turkish sellers and EU buyers. Uncertainty in the global market affects the Georgian market as well. While some Georgian exporters are implementing earlier contracts, others are still awaiting new ones.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.