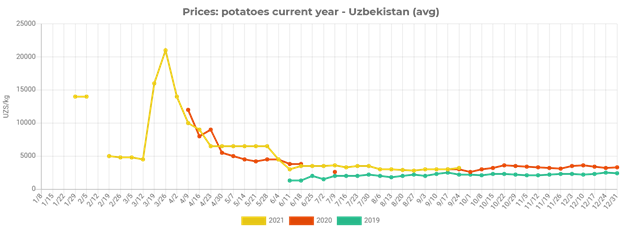

EastFruit analysts note that after Russia and Belarus, the potato price in Uzbekistan began to rise as well. Over the past two weeks, average wholesale prices for potatoes from the 2021 harvest in the country have risen by 17%, although they had remained stable since the beginning of August.

At the same time, potato prices in Uzbekistan are now at the highest level in the last three seasons and now amount to 3,500 UZS/kg ($0.33 per kg). At this time in 2020, they did not exceed 3,000 UZS/kg ($0.29), and in 2019 – 2,200 UZS/kg ($0.23).

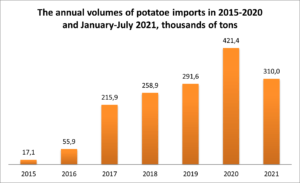

In previous seasons the increase in potato prices in October was insignificant, and there was no considerable increase in price levels until the end of the year. In 2021 the situation is completely different. After all, it is potatoes that are the main import position of the fruit and vegetable sector in Uzbekistan. Moreover, despite all the efforts to substitute imports, the imports of potatoes to the country keeps growing rapidly.

Accordingly, potato prices in Uzbekistan largely depend on the level of prices in the main supplying countries.

Where does Uzbekistan import potatoes from? In previous years, the main suppliers of potatoes to Uzbekistan were Kazakhstan, Russia and Kyrgyzstan. Moreover, Kazakhstan accounted for 76% of supplies in 2020, and the Russian Federation – about 17%. In other words, only two countries – Russia and Kazakhstan – supplied about 93% of potatoes to Uzbekistan. At the same time, the peak of potato supplies from these countries fell in September-November – the period of harvesting and the peak supply of potatoes in the markets of the Russian Federation and Kazakhstan.

However, in 2021, prices are high and growing rapidly both in Russia and Kazakhstan. Moreover, today EastFruit reported on potato prices reaching record levels in the Russian potato market over the past few years and market participants expecting further growth in potato prices.

As you can see from the chart, prices for potatoes in Uzbekistan are now lower than in Russia and Belarus. In addition, the situation with potato prices is the same in Belarus, and they are also record high. Accordingly, in order to intensify the import of potatoes from these countries, Uzbekistan will need to either significantly increase domestic wholesale prices for potatoes, or find alternative suppliers.

By the way, such alternative suppliers have already been partially found this year. In the first 7 months of 2021, Iran exported 119 thousand tons of potatoes to Uzbekistan, i.e. almost 39% of the total volume of Uzbek imports. The second place was taken by Kazakhstan, but prices are also actively growing there, and a deficit is also brewing. The third place was taken by Pakistan with a specific weight of 24% and a volume of potato supplies of 76 thousand tons. The cheapest potatoes in the region are now found in Tajikistan, they cost only $0.22 per kg – $0.11 cheaper than in Uzbekistan. So buying Tajik potatoes would be a good idea now. You can also try to buy potatoes in Poland and Moldova, where they are sold twice as cheap as in Uzbekistan. However, logistics will cost more.

It should be noted that imports from Pakistan and Iran are also unlikely to help keep potato prices in Uzbekistan from further growth. After all, they are also active in supplying potatoes to the Russian market. This means that here, too, the Russian market will remain more attractive than the Uzbek market, if prices in Uzbekistan do not start to rise significantly.

According to official data, the volume of potato production in the first half of 2021 in Uzbekistan amounted to over 1.5 million tons, which is 3.5% more than in the same period last year. However, as we analyzed in our study of the demographics of Uzbekistan and the growth in potato consumption per capita in the country, potato imports to Uzbekistan will continue to remain relatively high for quite some time. And if imported potatoes cost more, prices on the domestic market are likely to rise as well.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.