At the end of last week, Poland quite unexpectedly introduced a temporary ban on the imports and transit of Ukrainian agricultural products, and Hungary and Slovakia joined it a few days later. Similar measures are also being discussed in Romania and Bulgaria. Naturally, it was the restrictions on grain imports as the leading category of Ukrainian exports that got into the media’s focus.

However, EastFruit notes that many other types of agricultural products have also been banned, including fresh and processed vegetables and fruits. Although the transit ban was introduced only by Poland and was almost immediately lifted, import restrictions until June 30 are still in effect.

Let’s analyze how these measures by the neighbors of Ukraine will affect the Ukrainian fruit and vegetable market in months when the ban remains in force.

The exports of fresh vegetables, fruits, and most of their processed products, brought Ukraine a total revenue of $566 million last year, which, although less than in 2021 ($616 million), still remains one of the highest figures in the last decade.

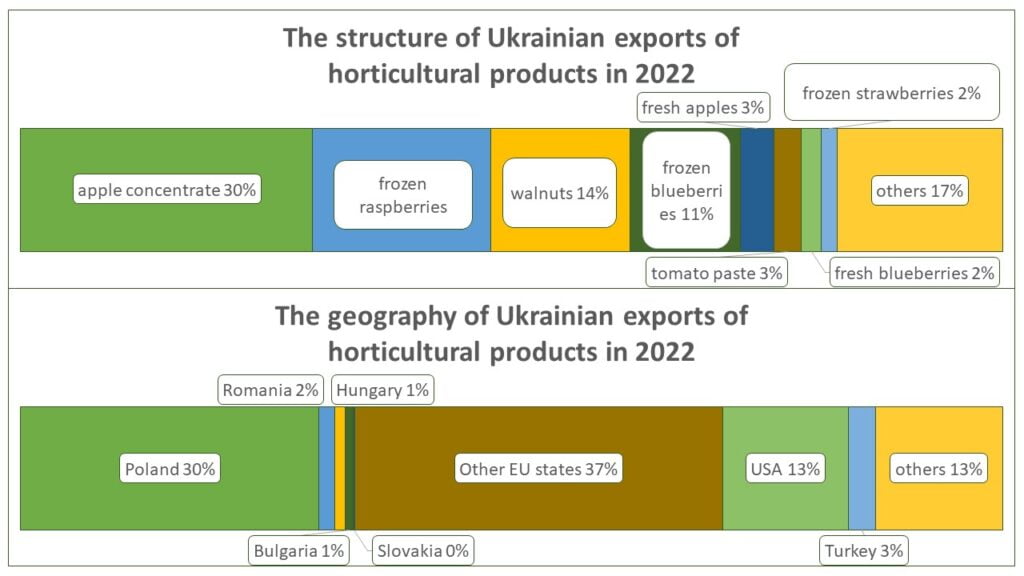

The Top-8 products, which accounted for about 83% of Ukraine’s total export revenue in 2022, included apple concentrate (nearly a third of total revenue), various types of frozen berries (almost a third in total), walnuts (14%), tomato paste, fresh apples and fresh blueberries (8% in total).

At the same time, Ukrainian vegetables and fruits (fresh or processed) were exported mainly to the EU markets (the total share is almost two-thirds of the total revenue), as well as the USA (13%), while the share of other destinations was much lower.

It should be noted that Poland provided almost a third of Ukraine’s foreign exchange earnings from exports in the fruit and vegetable segment in 2022. It is the import ban imposed by this country that will have the greatest negative effect on the Ukrainian industry because the total share of Romania, Bulgaria, Hungary, and Slovakia in exports from Ukraine last year was only a little over 3%.

We would like to draw your attention to the fact that, since the import ban is in effect from mid-April to the end of June, not all segments of Ukrainian exports will be affected by it. For example, exports of Ukrainian fresh blueberries peak in July-September, and the supply of frozen blueberries is also active from July. The exports of frozen strawberries will suffer from the ban, but it will almost not be reflected in the overall picture of the Ukrainian fruit and vegetable market due to the small volumes.

As for tomato paste, Ukraine practically became a net importer of it in 2022, and the largest producers of tomato paste are now restoring their production after the occupation and hostilities.

Similarly, the ban on imports will not have a huge impact on the Ukrainian segment of apples. Firstly, the main market for Ukrainian apples is the countries of the Middle East, while the share of all EU countries in the export structure remains minor. Secondly, the ban on transit from Poland has been lifted, while Romania has not yet introduced any restrictions, and the main port for sending Ukrainian apples by sea is the port of Constanta in Romania. Thirdly, the supply of export-quality apples in the country has decreased so much that Ukraine is likely to be forced to import them from Poland this spring.

Thus, the main negative effect of the ban on imports from Ukraine, introduced by a number of EU countries, will be observed in the segments of apple concentrate, frozen raspberries, and walnuts. Let’s see how important the trade in these products is for Ukraine and Poland during the period of the ban. We will not provide information on other countries because of their relatively small share of Ukrainian exports.

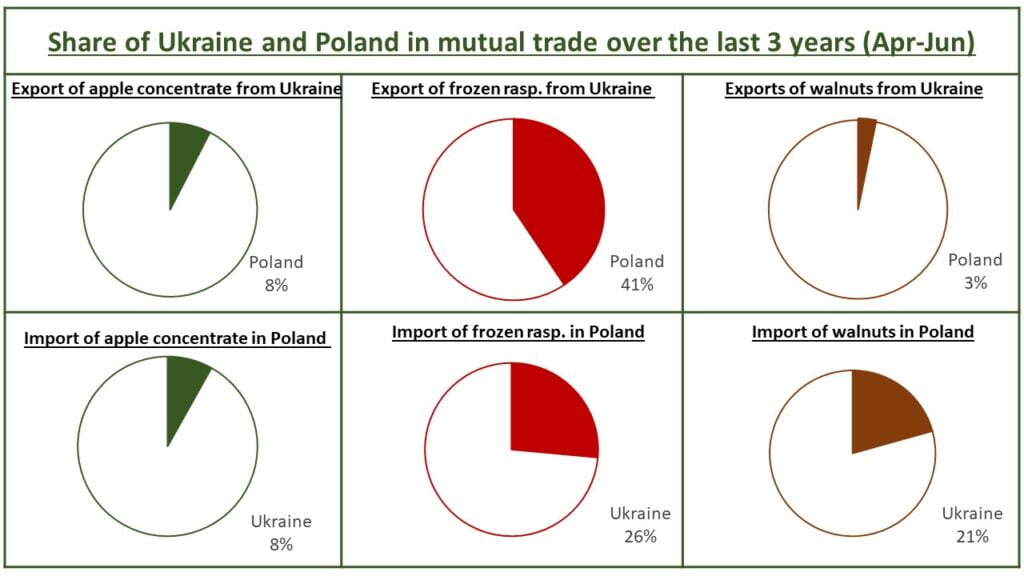

Ukraine will suffer the greatest damage from the ban imposed by Poland on the fruit and vegetable market in the segment of frozen raspberries. On average, Poland provided over 40% of all proceeds of Ukrainian exporters from frozen raspberry exports in April-June over the last three years. The ban poses a particular threat to Ukrainian freezing enterprises due to the record-high transitional stocks of raspberries in local storage facilities, which was described in detail in the article with comments by Taras Bashtannyk, President of the Ukrainian Horticultural Association.

There will also be an impact on the Polish economy from the ban, although less significant than on the Ukrainian one. Although Polish importers were mainly re-exporting Ukrainian frozen raspberries, part of them ended up on the local Polish market, being used by producers of yogurts, fillings, jams, etc. The ban imposed by Poland actually means up to a quarter of imported raspberries will disappear from the Polish market.

As for apple concentrate, Poland has recently ceased to be a key sales market for Ukraine, and the United States has taken its place in the ranking of importers. On average, Poland provided about 8% of the total revenue of concentrate exporters in Ukraine over the past three years in April-June, and the United States – about 40%. At the same time, the US is also the largest sales market for Polish concentrates, which means that the import ban imposed by Poland will only increase competition with Ukrainian products in export markets (the USA and other EU countries).

Even more catastrophic are the Polish restrictions on the local walnut market. For Ukraine, Poland brought only 3% of all revenue in April-June in the past three years, but the share of Ukraine in the market of imported walnuts in Poland reached 21%! In other words, the ban imposed by Poland deprived the local consumers of nuts (confectionery factories, etc.) of almost a fifth of their imports of a crucial component for their finished products!

Thus, if we consider exclusively the fruit and vegetable sector, the Ukrainian sector of frozen raspberries will suffer the main damage from the ban in the short term. With regard to some other products (apple concentrate and walnuts), the benefits to Poland from the imposed restrictions are most likely not to outweigh the losses.

The main effect of the restrictions is the very fact that such prohibitive measures were taken in a short period of time without consultations with the Ukrainian party. Ukraine has already gone through a history of similar relationships with bans and restrictions with Russia and Belarus, which, by the way, has led to increased competition with Poland for some products (apples in the Middle East or blueberries in the EU).

As a result, Ukrainian exporters will have to include the possible repetition of such restrictions by Poland, Hungary, Slovakia, and other countries in their future risk assessments. Meanwhile, the priority in Ukrainian exports will be given to states with a more predictable trade policy, and Ukraine will compete there, among others, with exporters from countries that impose bans.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.