According to EastFruit analysts, despite the world’s leading position in the exports of certain fruits and berries, such as fresh apples or frozen raspberries, Poland remains a major net importer of produce and could be a very attractive market.

According to EastFruit analysts, despite the world’s leading position in the exports of certain fruits and berries, such as fresh apples or frozen raspberries, Poland remains a major net importer of produce and could be a very attractive market.

Moreover, over the past five years, Poland has significantly increased imports of fruits and vegetables. In 2022, imports of produce to Poland, including the nuts and mushrooms segment, reached US $3.8 billion. At the same time, exports of fruits and vegetables amounted to US $3.1 billion, and the negative balance of international trade was close to $700 million.

It is clear that Poland is a huge produce trading country. For comparison, Uzbekistan, the largest exporter in the region, earns $700-800 million per year in exports, and Moldova – only $200-220 million. In other words, Moldova’s foreign trade turnover for fruits and vegetables is 20 times less than foreign trade turnover of Poland.

Not surprisingly, many suppliers from Ukraine, Moldova, Uzbekistan, Tajikistan and Georgia are interested in the prospects for supplying their products to the Polish markets and the possibilities of this market. Therefore, EastFruit analysts decided to show the structure and trends of fruit and vegetable imports in this country.

What vegetables and fruits does Poland import?

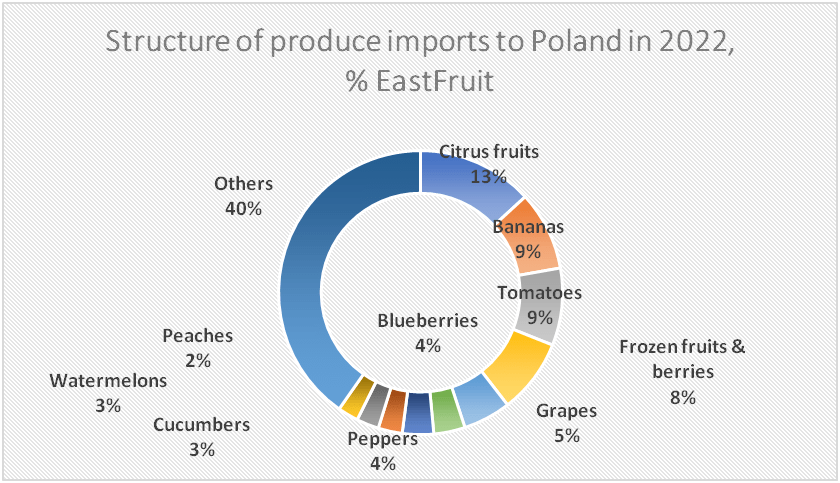

Like most other countries in the Northern Hemisphere, Poland’s main import item is the banana, which accounts for about 9% of imports by value. All citrus fruits account for about 13% of imports, and in general, these two categories of fruits, which are not grown in Poland due to climate limitations, account for 22% of imports.

Tomatoes hold the third place in terms of imports in the fruit and vegetable segment of Poland and account for another 9% – only slightly less than bananas.

It is interesting that Poland, being one of the world’s largest exporters of frozen fruits and vegetables, is also a very large importer of these products. Poland mainly buys frozen berries in Ukraine and then resells them to other countries of the world after refinement, which allows Polish traders to remain “in the market” even despite the problem of reduced local production.

The presence of blueberries among the top 6 most imported products is also noteworthy, because Poland is a major producer and exporter of these trendy berries. It is clear that local consumers have fallen in love with blueberries, and now they buy it all year round, and not only in July-October, when the locally grown blueberries are available on the market.

An important place in Poland’s imports is occupied by table grapes, which accounts for 5% of imports of all fruits and vegetables. Moldova already exports a lot of grapes to Poland, and the volume of trade is constantly growing.

Other important fruits and vegetables that Poland imports in large volumes are: greenhouse cucumbers and peppers, watermelons and melons, peaches and nectarines, avocados, frozen vegetables, dried onions, fresh strawberries, kiwi and fresh broccoli and cauliflower.

Imports of which vegetables and fruits to the Polish market are growing the fastest?

Over the past 5 years, the most significant increase in imports among the top 10 import positions of the Polish fruit and vegetable trade was shown by fresh greenhouse tomatoes, blueberries and frozen raspberries.

Imports of blueberries increased over this period by 4.7 times or ин $107 million, imports of frozen raspberries – by 3.7 times or $92 million, and imports of greenhouse tomatoes – by 65% or $132 million.

There is no decrease in imports in the top 10 for any item, but we must not forget that in 2020-2022 there was a significant increase in global inflation, which could have also inflated these numbers.

Outside the top 10, attention is drawn to the growth of watermelon imports – more than 2 times in 5 years in the amount of $49 million US dollars. Imports of cucumbers increased by 70% or $43 million, imports of other vegetables increased by 4 times or $57 million, probably, primarily, in the segment of the fresh herbs, imports of onions increased by 6 times or by $51 million. However, onion imports to Poland are subject to frequent and sharp fluctuations – sometimes they drop to almost zero, so it is not worth drawing far-reaching conclusions about this trend. We also note a rather sharp increase in imports of fresh and frozen strawberries to Poland.

What can EastFruit countries supply to Poland?

Central Asian countries such as Uzbekistan and Tajikistan can take advantage of the climate benefits and supply fresh out-of-season vegetables, fruits and berries to the Polish market. To do this they, however, need to work very well on the logistics and product quality and safety.

In our opinion, the most interesting segment for export from Central Asia to Poland may be frozen berries, fruits and vegetables. Significant fruit and vegetable freezing capacities have already been established in Uzbekistan, but major efforts are needed to improve the quality of raw materials and finished products, as well as to ensure compliance with product safety standards.

The same applies to export opportunities from Ukraine, Moldova and Georgia. These opportunities are already actively used, because Poland is the largest importer of Ukrainian frozen fruits and berries but there is always a potential to boost trade further.

Blueberries from Georgia can find an excellent niche in the Polish market: at the end of the Spanish season and before the beginning of the Ukrainian one. Similarly, fresh Ukrainian and Moldovan blueberries may appear in Poland approximately 10 days before harvest in Poland, and this window of opportunity can be exploited.

Given the shortage of labor in Poland, one can expect new export opportunities to arise in this country for a range of fresh berries, primarily from Ukraine and Moldova, which can have fast and inexpensive logistics to Poland.

Moldova already exports a lot of table grapes to Poland. An increase in supplies is possible if the production of seedless varieties is developed, which will be in higher demand than the Moldova variety. We can also consider deliveries from Central Asia in case of an improvement in the situation with the varietal composition.

Also, deliveries of super-early watermelons and melons to Poland can be interesting. This segment has already been “seen through” by suppliers from Morocco, who is increasing exports to the EU countries at a very high pace. Therefore, farmers from Uzbekistan and Tajikistan need to study the experience of this country, first of all, because their logistics will be quite expensive, and they need to offer a competitive product in terms of quality. There are big questions about the varieties of watermelons and melons grown in Central Asia, since these fruits do not always meet the expectations of consumers in Poland.

The early segment of stone fruit crops such as apricot, cherry, peach, nectarine and plum can also be interesting, but suppliers need to learn how to grow products that compete with Turkish products in terms of quality and caliber. And the early sweet cherry, in Central Asia, as we know, has a very small caliber, as shown, for example, in this video.

As experience shows, periodically, approximately once every 4-5 years, there may be a good opportunity to export onions from Uzbekistan and Tajikistan to Poland. However, it is definitely not worth betting on this. And this year, both Uzbekistan and Tajikistan completely banned exports at the peak of demand for onions in Poland, although they could have made good money on this.

The possibility of exporting to Poland, especially early fresh cauliflower and broccoli, cannot be discounted. True, it will not be easy to meet the requirements for logistics and quality here, but there is nothing impossible in this, provided that a competitive price is assured and both countries have a major advantage in labor costs over Poland.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.