The export season of walnuts from Ukraine in 2022 began with record lows, and prices for the walnut kernels in the Ukrainian market continue to disappoint producers and suppliers, EastFruit reports.

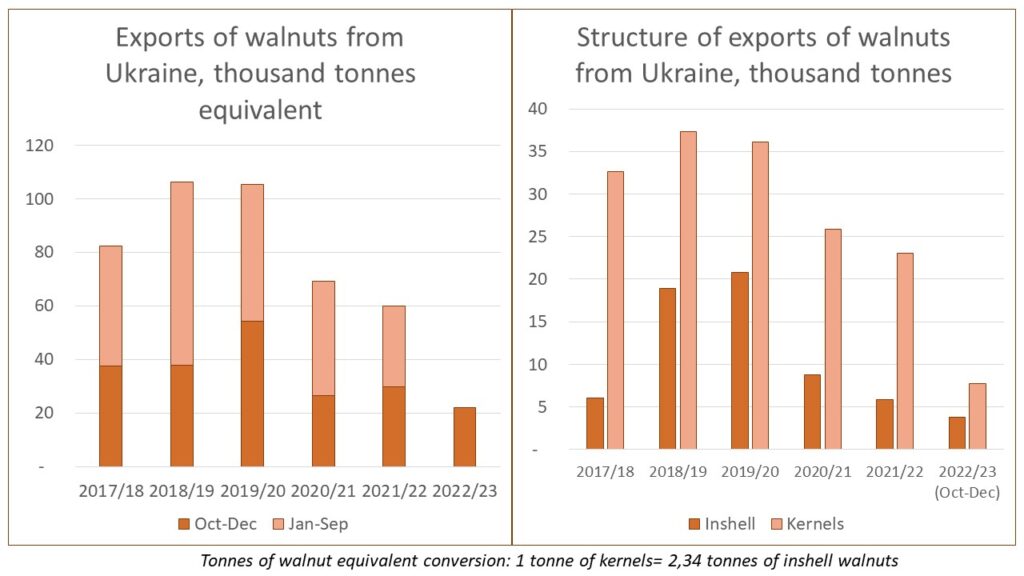

In the first three months of the 2022/23 season (October-September), Ukrainian exporters sold only 1 400 tonnes of inshell walnuts and 3 100 tonnes of shelled walnuts abroad. Compared to the same period of the previous season, exports fell by 26%, and if compared to the average for the previous five seasons, the drop will be even more significant – 41%!

“The exports of walnuts from Ukraine have been steadily declining over the past two seasons, and the current season was no exception. Naturally, one of the key reasons for such trends was the consequences of full-scale aggression by Russia, including the occupation of the South of Ukraine and attacks on civilian infrastructure followed by blackouts. Nevertheless, the drop in Ukrainian exports is also due to the fact that a new major player quite unexpectedly appeared on the global nut market, China, which began to quickly oust its competitors, including Ukraine,” explains Evhen Kuzin, head of the analytical department of the “APK-Inform: Vegetables and Fruits” project.

Although in recent years large areas of varietal walnuts have been laid in Ukraine, the bulk of Ukrainian exports are walnuts collected from non-professional orchards or plantations. This fact presents a huge problem for ensuring the quality of walnuts for export because it is quite difficult to collect a homogeneous batch of in-shell or processed walnuts from different suppliers.

“As a result, Ukraine reduced exports during the previous two seasons, because the global industry was in a COVID-19 crisis, and demand for nuts, especially low-quality nuts, fell sharply. Moreover, quality problems, exacerbated by the consequences of the war, once again prevented the country from increasing exports this year, when the demand for nuts in the world has intensified due to the restoration of their consumption,” Evhen Kuzin continues.

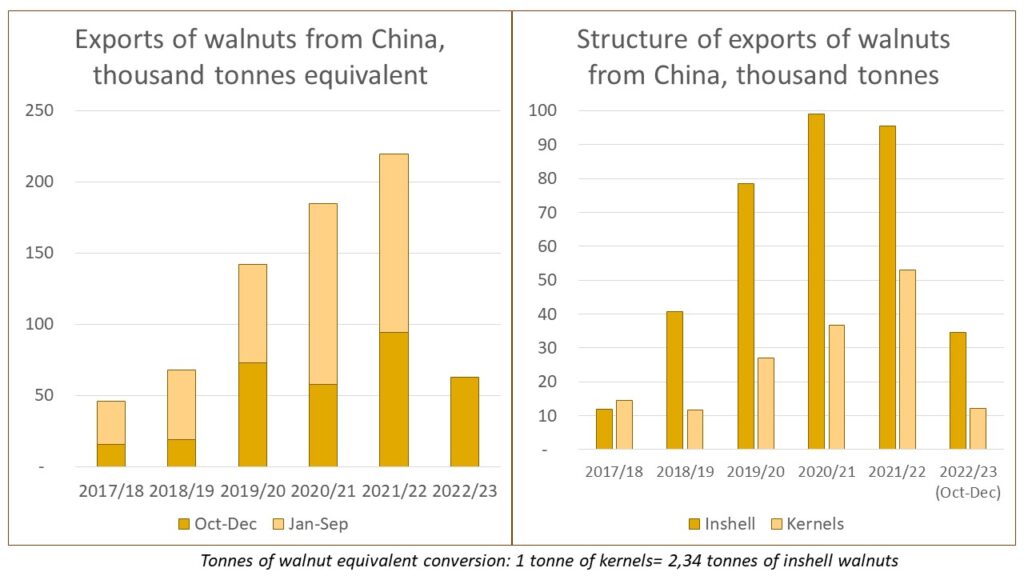

Another factor of pressure on the global walnut market in recent years has been exerted by China, which, by the way, exported less walnuts than Ukraine in the 2017/18 season and was the 5th largest exporter in the world (Ukraine ranked 4th). A few years later, and despite the COVID-19 crisis among walnut consumers, China increased its export volumes by almost five times by the 2021/22 season and became the second largest exporter of walnuts in the world after the United States!

“In the past few years, China has made a huge leap in providing quality walnuts to local and overseas consumers. New plantations with modern varieties of nuts with an increased weight of kernels, as well as mechanization of growing and harvesting to keep the cost low, is the main recipe for the success of Chinese exporters in the global market,” Evhen Kuzin says.

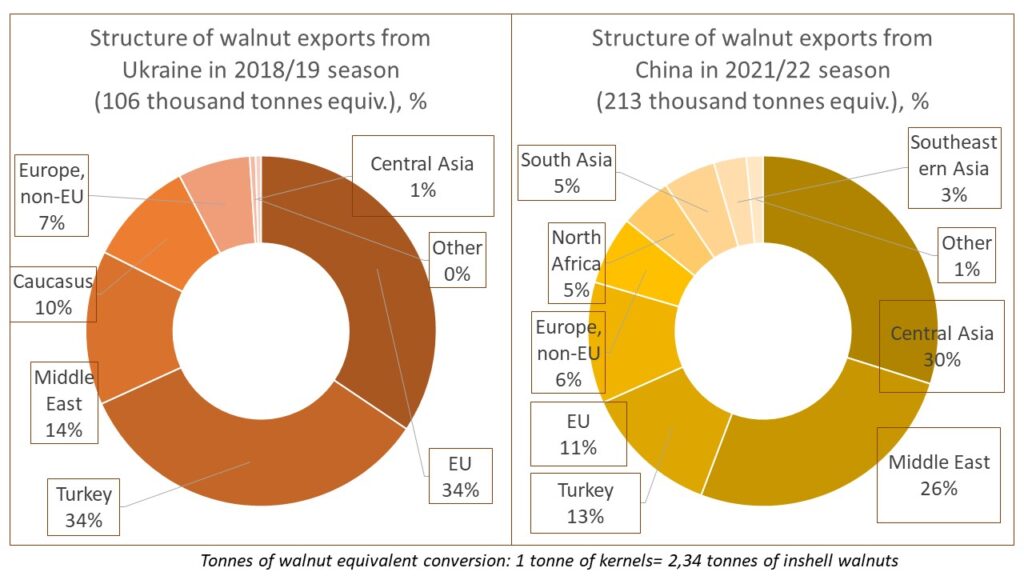

As a result, China not only increases exports to those countries where Ukraine used to supply walnuts but also develops new export directions, which puts additional pressure on the global market. Thus, both for Ukraine and China, the markets of Turkey, the EU, and the Middle East are among the key in the export of walnuts, and competition is intensifying there. Back in the 2018/19 season, these three markets provided over 80% of all Ukrainian exports, and China focused on them in its supplies.

“As a result, China’s exports to Turkey were almost five times higher last season than Ukrainian ones, and exports, for example, to the UAE or Germany, were almost twice as high. In addition, China is actively developing markets that are logistically inconvenient or unknown for Ukraine. Thus, a little less than a third of Chinese exports are directed to Central Asia, and about 8% more to the countries of South and Southeast Asia – regions where Ukrainian products are practically not represented,” Evhen Kuzin emphasizes.

It should be noted that operating conditions in the global walnut market in the second half of the 2022/23 season will be even tougher, despite the recovery in demand from confectionery, catering, and other walnut consumers. Walnut production in China in 2022, according to the FAS USDA, reached a record in recent years, and the harvest in the US, EU, and Turkey was among the highest.

“Due to the lifting of COVID-19 restrictions in China, which previously somewhat hindered exports, and the restoration of supply logistics, sales of walnuts from this country can increase much. And this, given the large harvest of walnuts in the world, can lead to further pressure on prices, which are already low in Ukraine from the very beginning of the season. Unfortunately, due to quality problems and the consequences of the war, Ukrainian exporters will most likely not be able to fully take advantage of the recovery in global demand for walnuts, and suppliers from other countries will continue to take over market share from Ukraine,” Evhen Kuzin concluded.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.