This year has brought many surprises to Tajik farmers. EastFruit analysts spoke to Tajik fruit and vegetable producers, exporters, and other participants in the fruit and vegetable business of Tajikistan, to determine the most significant events in the fruit and vegetable business of Tajikistan in 2022 that will go down in history.

- Politics as the main factor influencing the economy and horticulture business of Tajikistan

It is impossible to avoid mentioning political factors in 2022. Moreover, they had the greatest impact on the fruit and vegetable market.

As you know, the economy of the fruit and vegetable business in Tajikistan is focused on the Russian market, and the main revenue in foreign currency comes from this country in the form of remittances from labor migrants. After the well-known events since February 2022, the exchange rate of TJS against USD in the markets at the beginning of the year rose to 14 TJS per USD, and then sharply decreased to 9.5 TJS, which was due to fluctuations in the exchange rate of the RUB against the USD and the RUB against the TJS. This led to chaos in the business, including in the fruit and vegetable business, in the first half of the year, since it was difficult to plan sales. In addition, the purchasing power of the population in the Russian Federation has fallen, and, accordingly, the demand for products from Tajikistan has decreased.

Another factor is the ongoing conflicts on the border of Tajikistan with Kyrgyzstan, which have effectively closed the sale of vegetables and fruits through this country and to the market of Kyrgyzstan itself. After all, earlier it was Kyrgyzstan that was both a buyer and a transit country for Tajik products. This factor had a particularly negative impact on the markets of table grapes and cherries. The conflict at the border also affected the cost of transportation to other countries – export costs increased.

The domestic policy did not contribute to the development of the fruit and vegetable business. The ban on the export of onions from Tajikistan, introduced in the summer by the government of the country, led to the stabilization of prices in the domestic market but cooled the entrepreneurs who worked for export. Importers switched to buying onions from competitors – Uzbekistan and Kazakhstan, which did not impose such restrictions. Accordingly, the money from the export of onions, which could have gone to farmers in Tajikistan, was earned by other countries.

- Excess table grapes of old varieties

Our experts have repeatedly warned that it is necessary to change approaches to growing grapes and plant new varieties that are in demand on the market in Tajikistan. Unfortunately, new vineyards planted this year on hundreds of hectares are again grapes of the same old varieties that have traditionally been grown over the past decades.

The situation in Tajikistan in terms of the structure of existing varieties is identical to neighboring Uzbekistan. We advise you to read this study, published a year and a half ago and forecasting the difficulties with grape sales in the region, which, as we see, are confirmed.

At the very height of the grape season, there was almost no demand in the local market. As a result, prices for grapes of the first grade of export quality fell to $0.30 from the farmer, and the price of grapes of the second grade from the farmer was $0.20-0.25/kg. In addition to the impossibility of exporting through Kyrgyzstan, there was no demand from traditional importers from Kazakhstan and Uzbekistan. Therefore, many wine growers in Tajikistan are thinking about uprooting their vineyards.

Success in this business, given the remoteness of the country from markets, requires high-value seedless varieties known globally, as well as well-established export logistics. Single deliveries, mainly from Uzbekistan or from local growers, of seedlings of promising varieties cannot be considered, because they do not fundamentally change the situation, and their cost was very high – two-year-old seedlings of promising grape varieties in Tajikistan were sold from $30 to $90 per piece!

We remind you that there are a lot of videos about table grapes on our YouTube channel, the experience of growing them (including in greenhouses), storage, and export, mainly from Moldova. You can read about the experience of growing and exporting early table grapes from Italy here.

- Record low prices for carrots

The massive losses of entrepreneurs and owners of cold storage facilities this year came as a big shock to vegetable growers. Carrots of the 2021 harvest were put into storage, but there was no expected price increase. Moreover, carrots that were stored until June 2022 could not be sold even at half the purchase price. If we add the huge losses in weight and quality, as well as the costs of storage and frozen funds, this experience once again confirms what EastFruit experts have been saying constantly and for many years. “Storage is not a separate business, but an integral part of the growing and sale business of vegetables and fruits to be stored. Buying vegetables and fruits for storage in the hope of a subsequent price increase is not fundamentally different from playing in a casino, there are simply more risks in the vegetable business,“ says Andriy Yarmak, an economist at the FAO Investment Centre. His blog on the matter can be read here.

It is natural that after 2021, which became extremely successful for those who grew and harvested carrots, when the retail price of carrots was five times higher than usual and reached 10 TJS ($0.88/kg), in 2022 many wanted to repeat this success. Of course, the demand for carrots during the harvest increased, and the supply at the time when prices should have risen, on the contrary, fell sharply. Moreover, in Russia, the main market for vegetables from Central Asia, there were abnormally high prices and abnormal demand last year, which also led to an increase in domestic production, as well as in other countries that supplied carrots to the Russian market, especially in Uzbekistan and Kazakhstan.

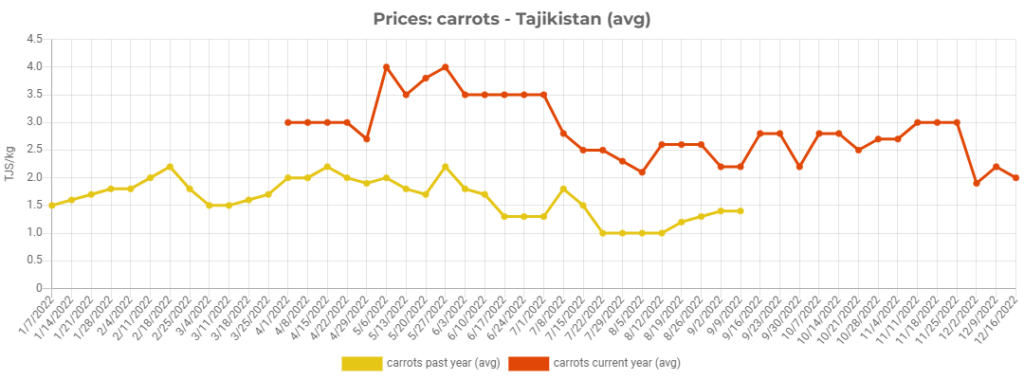

In 2022, part of the carrots was sold in the Russian Federation, but after an increase in supply in the markets of the Russian Federation and countries of Central Asia, prices fell there as well. That is, even after the fall in prices in Tajikistan, the difference in price with Russia did not justify the transport costs of exports from Tajikistan. Below is a chart of carrot prices within Tajikistan, which shows that the price of carrots has been relatively stable, which did not justify the cost of laying and storage, as well as the decline. Carrots of the new crop, which became available on April 1, made the business unprofitable for those who stored carrots for 3 to 9 months.

- The onion business won, but could not collect the gain

Unlike those who bet on carrots, vegetable growers and traders who bet on onions were very lucky. Although the situation for onions could well become as unpleasant as for carrots.

Despite the fact that the price of onions in Tajikistan had fallen to an incredible $0.04/kg and there was a risk of another collapse in onion prices, local farmers did not reduce the area planted with onions for the 2022 harvest. And they are lucky.

First of all, Russia’s barbaric destruction of vegetable growing in the southern regions of Ukraine, which have been under Russian occupation since the spring of 2022, has led to the fact that onion production in this country has decreased from 1 million tonnes by about half, and Ukraine has turned from an exporter into an importer of onions.

Secondly, unprecedented flooding in Pakistan sharply reduced domestic onion production and created opportunities for their supply from Tajikistan to the Pakistani market. Moreover, onion prices have increased in all countries of the region.

Thirdly, Russia artificially strengthened its currency, which made deliveries to the Russian market when paid in rubles quite attractive from an economic point of view. Moreover, in countries that traditionally supplied onions to Russia, onion prices also increased.

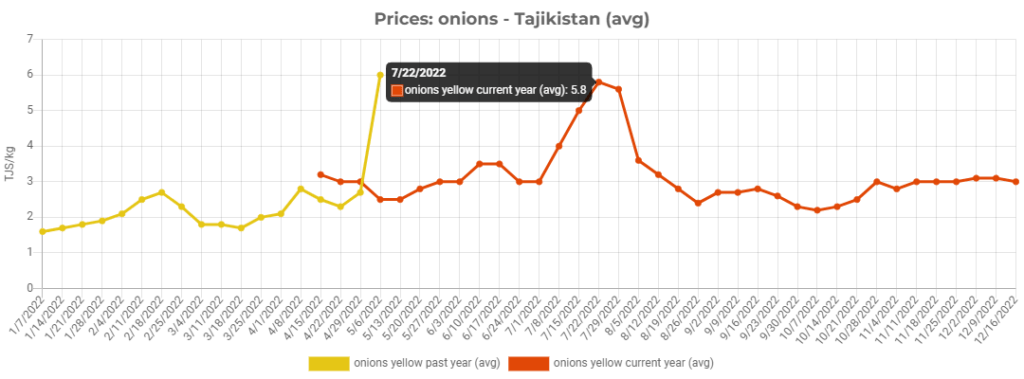

However, farmers did not rejoice for long – the increased export of onions led to the fact that prices in the domestic market rose to 7 TJS, causing dissatisfaction among citizens. As a result, Tajikistan simply banned the export of onions, and prices fell more than twice to 3 TJS in just one week.

Thus, the ban led to the sponsorship of farmers in Uzbekistan, who could further raise prices for onions and earn the money that the farmers of Tajikistan lost.

At the time of writing, the ban on the export of onions from Tajikistan has not yet been lifted. And traditional buyers have shifted their focus to onion imports from neighboring Uzbekistan. It will not be easy to return them even after the ban on onion exports is lifted.

In anticipation of the high demand for onions in 2023, the areas of winter onion plantations were increased. The areas for planting onions in December-January are also being actively prepared now. However, if the export ban is not lifted, onions will not be needed in such volumes and may end up in a landfill.

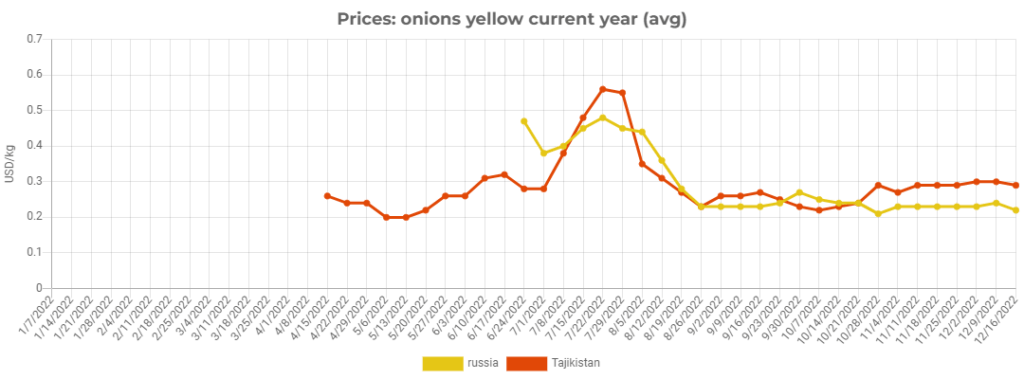

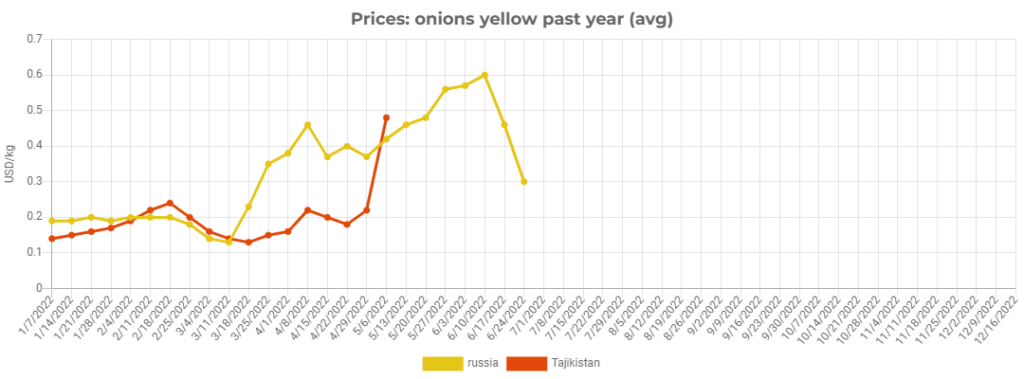

The charts below show a large difference in onion prices in Tajikistan and the Russian Federation from March to the end of July 2022.

- Spring frosts and low harvest of apricot and peach

2022, like 2021, turned out to be extremely difficult for Tajik apricot producers in terms of the impact of weather conditions on the crop. Unfortunately, this has already been repeated for the second year in a row, while previously this happened no more than once every 5-6 years. Climate change and the frequency of cataclysms are increasing.

And again, 2 days of snow and frost at the end of March during the flowering of stone fruits brought irreparable damage to the apricot crop, and again the blow was struck in the northern part of the country, where more than 80% of all apricot plantations are located and dried fruit processing enterprises are concentrated.

In the Khatlon region, there were apricots, and all the beloved “gura” (green unripe apricot – delicacy) were supplied from the orchards of southern Tajikistan. As a result, farmers did not get more than 90% of dried fruits, and as you know, dried apricots are a kind of alternative currency in Tajikistan (see a video on how to harvest, dry and sell apricots here). The result of weather disasters was a decrease in the production of stone fruits, including peaches and nectarines. Consequently, their supply on the Tajik market was very limited, and there were even imports from neighboring Uzbekistan.

Many apricot processing enterprises also drastically reduced processing volumes due to the lack of raw materials, and some were completely idle. Others have continued to import apricots from northern Afghanistan, as they did in 2021. As a result, many plans for the export of apricots and dried fruits were not implemented, and contracts were not fulfilled. At the same time, prices for dried fruits in the region have increased significantly over the past couple of years.

It is interesting to note that our material on the importance of dried apricots for Tajikistan, published two years ago, continued to be very relevant in 2022, gaining more than 168 000 views.

- New retail stores open

The Eastfruit team continues to conduct audits of the fruit and vegetable departments of supermarket chains, which our readers are reading and waiting for (they were done in March, July and November). The results of the audit showed that the service has improved in all chain stores, which led to an improvement in the general condition of retail and fruit and vegetable trade, in particular.

It is gratifying that in 2022 a number of stores opened in Dushanbe and neighboring regions and cities, including Evar stores (already 12 stores), a number of Bi1 stores (already 11), two Paykar stores (now there are more 5), and finally a new store of the AMID chain opened in Khujand (now there are 4 of them). Interestingly, the new stores “Evar”, “Bi-1” and “Paykar” opened in November 2022 – the best time to prepare for the New Year sales.

New stores of a new format are more convenient for customers. Although Tajikistan still lags far behind other countries in the region in terms of the level of “supermarketization” of the country, the progress is obvious.

Read the results of the audits of the fruit and vegetable departments of supermarkets for November 2022 at the following link: Dushanbe and Khujand.

- Reducing the volume of growing tomatoes in heated greenhouses

In the markets of Tajikistan, open-field tomatoes are usually sold until the end of October. Traditionally, from October to May, the market received products from heated greenhouses, and from March – from unheated greenhouses in the Khatlon region.

Due to a combination of factors such as diseases, low yields, high coal prices, lack of trained personnel, lack of established export channels, and as a result, the high competition during peak harvest periods (December-February) in the domestic market, many Tajik greenhouses in 2022 abandoned the cultivation of tomatoes in favor of cucumbers, herbs, and peppers.

The niche was taken by imports from Uzbekistan. Already from December to March, there are cheap and high-quality greenhouse tomatoes from Turkmenistan, where product prices are usually even more affordable than in Uzbekistan. Starting in March, open-field tomatoes from Pakistan enter the markets every year, breaking the price.

Early production from greenhouses in southern Tajikistan is also a factor in lowering domestic prices, making production in heated greenhouses even less economically feasible.

- High prices for raspberries and difficulties in selling frozen raspberries

For raspberry farmers in Tajikistan, 2022 turned out to be very profitable, which was a direct result of the rush demand for frozen raspberries on the global market in 2021 and record prices.

As a result, the trend has also affected Tajikistan, where only recently the first enterprise for deep (static shock) freezing of berries and fruits was launched. Prices for raspberries from farmers started from $2 and reached $4/kg! And these are raspberries of local varieties, which do not meet the minimum quality parameters of the global market.

Previously, such raspberries were sold at $1-2/kg, and it was still very profitable. High purchase prices in Tajikistan for raspberries were provided by buyers from Uzbekistan. In 2020-21, many modern large freezing enterprises opened there, and a year earlier they managed to make good money exporting frozen raspberries. Therefore, they decided to increase the volumes for 2022 as well, expecting the same high prices. And this helped Tajik raspberry growers earn good money.

But the processors were at a loss because the global market for frozen raspberries collapsed. After the hostilities in Ukraine and, subsequently, attacks on civilian infrastructure such as power plants,

Ukrainian frozen raspberry producers preferred not to store raspberries, but to sell them at the lowest possible price. Yes, and the demand for raspberries in the world has fallen sharply due to their too-high prices and a decrease in consumer income in many countries of the world.

Therefore, processors will not offer farmers such high prices for raspberries next year. Although many have already expanded plantations under raspberries this year.

- The collapse in lemon prices and bitter prospects for local citrus production

Lemon production in Tajikistan has continued to expand rapidly in recent years. A particularly strong impetus for business development was the rush demand for lemons during the COVID-19 pandemic. However, 2022 was also a real shock for the lemon industry – there is no demand for lemons, prices are falling, but consumption is not increasing.

We have detailed the difficult situation in the citrus industry in Tajikistan and neighboring Uzbekistan in our December 12, 2022 story, which is available here. A summary – the production of lemons in Tajikistan exceeds the needs of the domestic market, it is difficult to expect high prices, as the type of lemon that is grown in the country and the way it is grown, as well as the infrastructure for export, are uncompetitive in the global market.

In other words, 2022 put the fruit and vegetable sector of Tajikistan in front of the need to introduce fundamental reforms in many segments. The time has come for a radical renewal of the varietal composition and technologies for growing, processing, storing, packaging, and logistics of many types of fruit and vegetable products to remain competitive. Otherwise, we should expect not only a reduction in exports but also an increase in imports.

Have we missed anything important? If so, please write about it in the comments!

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.